TL;DR

-

Independent contractors offer flexibility, niche expertise, and faster onboarding without the long-term costs of employees.

-

Hiring independent contractors internationally adds complexity, mainly because each country has unique laws, tax rules, and compliance tests.

-

Key steps include defining the role, confirming contractor status, setting payment terms, and protecting IP.

-

Essential paperwork includes contractor agreement, statement of work, tax forms, IP assignment, NDA, and DPA.

-

Independent contractor risks include misclassification, payment issues, and legal disputes. These can be mitigated with clear contracts and local compliance checks.

-

Rivermate’s Contractor of Record service manages classification, contracts, payments, and compliance in 150+ countries, helping you hire globally with confidence.

How to Hire an Independent Contractor Legally & Globally

Hiring an independent contractor can be a smart way to bring specialized skills into your team without the obligations of a full-time hire. Whether it’s a designer for a short-term campaign or a developer for a specific project, contractors offer flexibility, speed, and cost control.

But when you cross borders, things get more complex—every country has its own labour laws, tax rules, and compliance requirements. Misclassification, late payments, or poorly drafted contracts can create serious financial and legal risks. That’s why a structured, compliant hiring process is essential.

This guide walks you through each stage, from defining the role to managing payments—so you can work with contractors confidently, wherever they’re based.

What is an independent contractor?

In simple terms, an independent contractor is a self-employed professional who provides services to a business under the terms of a contract.

Unlike employees, contractors control how, when, and where they work. They typically supply their own tools, decide their working hours, and can work with multiple clients at the same time.

| 💡 The distinction between a contractor and an employee matters because it determines tax treatment, benefit entitlements, and compliance responsibilities. |

For example, employees are usually entitled to statutory benefits, protected working hours, and employer-covered taxes. Contractors, on the other hand, manage their own taxes, don’t receive employee benefits, and have greater autonomy over their work.

However, when hiring internationally, the definition of “independent contractor” varies from country to country. Some jurisdictions have strict tests to determine worker status, focusing on factors like the degree of control, integration into the company, and dependency on a single client.

5 reasons why you should hire an independent contractor

Hiring an independent contractor isn’t just about filling a skills gap—it’s about matching the right work model to your business needs. Here are five concrete, real-world reasons companies choose contractors over full-time hires:

1. Specialised expertise on demand

Need a niche skill like designing or web development for a short-term project? Contractors often bring deep expertise from working across multiple clients and industries, letting you plug in high-level talent exactly when you need it.

2. Faster onboarding, less disruption

Unlike full-time roles that require lengthy hiring cycles, contractors can often start work within days—especially when onboarding is handled through a Contractor of Record.

3. Flexible resourcing across time zones

Contractors can be engaged for specific hours, deliverables, or milestones. This flexibility is particularly valuable for companies operating globally, where demand might peak at different times.

4. Reduced long-term commitments

You pay only for the agreed scope—whether that’s a fixed project fee or hourly rate—without ongoing payroll, benefits, or redundancy costs. This makes budgeting more predictable for short-term or variable workloads.

5. Access to talent in new markets

When expanding into a new region, contractors allow you to test the waters without setting up a local entity. With the right legal structure, you can work with top talent in-country while avoiding misclassification risks.

| Compliance tip: In many jurisdictions, these advantages disappear if the contractor relationship starts to resemble employment. Local tests vary, but factors like control, exclusivity, and integration into the business are key red flags. |

Pre-hiring checklist: 6 steps before bringing on a contractor

Before you send out a contract or agree on rates, make sure you’ve ticked off these essentials. Skipping them can lead to misclassification issues, payment delays, or even penalties in certain countries.

1. Define the role and scope clearly

Write down the specific deliverables, timelines, and outcomes. Avoid wording that mirrors an employee job description, as this can blur the legal distinction.

2. Confirm contractor status under local law

Check how the jurisdiction defines an independent contractor. Some countries apply strict tests that go beyond basic contractual terms. For example, California (USA) enforces the “ABC test,” requiring contractors to be free from your control, work outside your core business, and operate their own independent trade.

Japan evaluates independence based on the absence of direct supervision, restrictive covenants, and day-to-day management, while prohibiting certain “worker supply” arrangements.

If the role doesn’t pass these jurisdiction-specific tests, you may be legally required to offer an employment contract instead.

3. Set a payment structure that aligns with independence

Decide whether you’ll pay hourly, per milestone, or on completion. Avoid paying like a salary (same amount on the same date every month) unless it’s standard for contractors in that market.

4. Plan for tax and compliance obligations

Understand whether you need to withhold taxes, register the contractor, or report payments to local authorities. Requirements vary widely between countries.

5. Protect intellectual property and confidentiality

Include clauses that ensure work produced belongs to your company and that sensitive information is safeguarded—especially important for cross-border engagements.

6. Choose a compliant onboarding method

For multi-country teams, consider using a Contractor of Record like Rivermate to handle contracts, classification, and local legal requirements—reducing the risk of costly mistakes.

Finding the right independent contractor

Not all contractors are created equal. Use these pointers to assess candidates objectively—especially when hiring across borders.

| Criteria |

Why it matters |

What to check |

| Relevant expertise |

Ensures the contractor can deliver without a steep learning curve. |

Review portfolio, case studies, or client references in your industry. |

| Proven reliability |

Missed deadlines can derail projects, especially in time-sensitive markets. |

Ask about past turnaround times and verify with former clients. |

| Communication skills |

Smooth collaboration is harder across time zones and cultures. |

Gauge responsiveness during early discussions and test with a small trial task. |

| Understanding of local compliance |

Contractors aware of their own tax and reporting obligations reduce risk for you. |

Ask how they handle invoicing, taxes, and business registration in their jurisdiction. |

| Technical readiness |

Delays often stem from equipment or software gaps. |

Confirm they have the tools, internet speed, and security measures for the job. |

| Alignment with contract terms |

Resistance to certain clauses can signal future disputes. |

Share key terms early—especially around IP ownership, confidentiality, and payment schedules. |

Table caption: Pointers to assist in finding the right independent contractor

| Pro tip: Document your evaluation. A paper trail of why you classified someone as a contractor can be invaluable in the event of a misclassification audit. |

Check out our country guides to get a detailed take on how to hire across the world with full compliance.

Compliance document pack: Essential paperwork for hiring contractors

When engaging contractors internationally, the right paperwork does more than set expectations. It protects your business, safeguards intellectual property, and demonstrates compliance if audited. Here’s what to include:

| Document |

Purpose |

Key global considerations |

| Independent contractor agreement |

Defines the scope, deliverables, payment terms, and timelines. |

Ensure the language reflects independence—avoid clauses that imply employee-like control. |

| Statement of work (SOW) |

Details the specific tasks and milestones for a given project. |

Tailor for each market; some jurisdictions treat overly broad SOWs as signs of disguised employment. |

| Tax forms |

Meets local reporting and compliance obligations. |

In the US, collect a W-9 (domestic) or W-8BEN (foreign). Other countries may require local equivalents or proof of business registration. |

| Intellectual property (IP) assignment |

Transfers ownership of work created to your business. |

In some countries, IP rights don’t automatically transfer without explicit clauses. |

| Non-disclosure agreement (NDA) |

Protects confidential business information. |

Verify that it’s enforceable in the contractor’s jurisdiction. |

| Data processing addendum (DPA) |

Ensures data handling meets global privacy laws like GDPR. |

Critical if the contractor processes personal data from regulated regions. |

Table caption: Hiring independent contractors involves essential paperwork

| Compliance tip: Keep signed copies and supporting classification evidence in a secure, centralised system. If using Rivermate’s Contractor of Record service, these documents are standardised for each country and stored in-platform for audit readiness. |

Pros and cons of hiring an independent contractor

| Pros |

Why it matters |

Cons / Risks |

How to mitigate |

| Cost flexibility |

Pay only for agreed deliverables or hours—no ongoing payroll or benefits. |

Higher hourly/project rates than employees. |

Budget for total project costs and compare with employee TCO (total cost of ownership). |

| Specialised skills |

Access niche expertise quickly without long recruitment cycles. |

Knowledge may leave with the contractor. |

Negotiate knowledge transfer or documentation as part of the deliverables. |

| Faster onboarding |

Can start work in days when contracts and compliance are in place. |

Rushed hiring can lead to poor fit or compliance errors. |

Follow a structured vetting and onboarding checklist. |

| Global reach |

Hire talent in markets without setting up a local entity. |

Cross-border compliance is complex; misclassification risk. |

Use a Contractor of Record like Rivermate for localised contracts and classification. |

| Scalability |

Adjust resources up or down based on workload. |

Less control over availability and prioritisation. |

Set clear timelines, communication expectations, and penalties for delays. |

Caption: Pros and cons of hiring an independent contractor

| ⚠️Note: The “cons” aren’t dealbreakers as such. But, they’re significant risks that can be managed with the right processes, contracts, and local compliance support. |

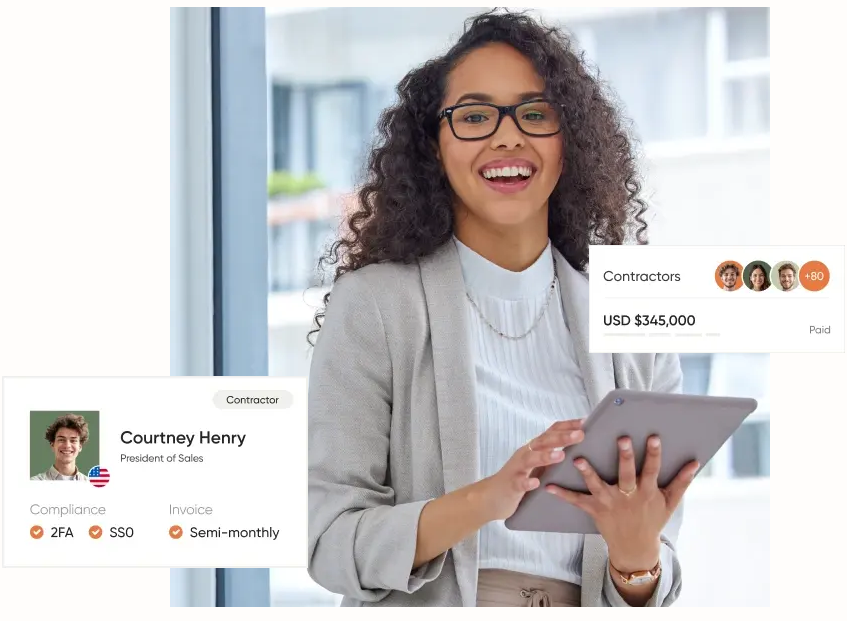

How Rivermate streamlines independent contractor hiring in 2026

Hiring contractors across borders shouldn’t feel like navigating a legal minefield. Rivermate’s Contractor of Record service is built to handle the complexity—so you can focus on getting work done. Here’s how it addresses each key challenge:

Eliminating misclassification risk

Every country defines “independent contractor” differently, and getting it wrong can mean misclassification penalties or back taxes. Rivermate tackles this with a built-in classification engine and country-specific contracts, ensuring that each engagement meets local labour law requirements.

Image caption: Rivermate tackles this with a built-in classification engine and country-specific contracts

Image caption: Rivermate tackles this with a built-in classification engine and country-specific contracts

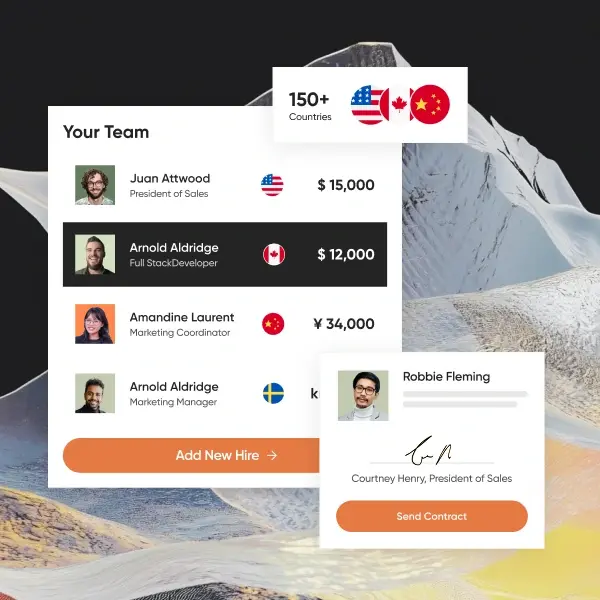

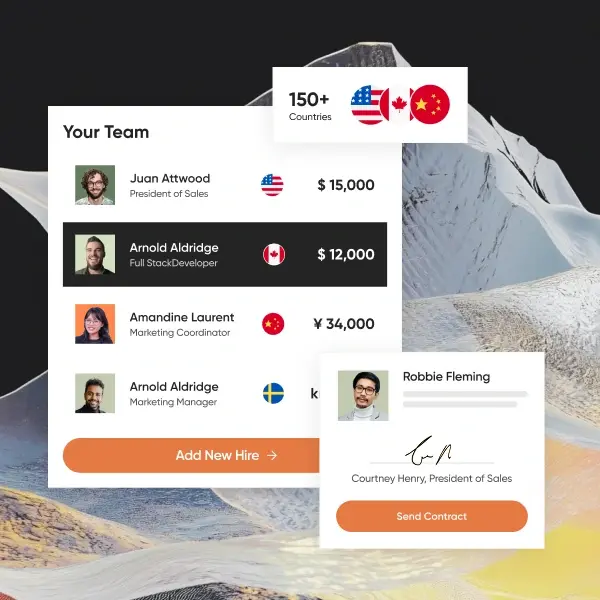

Delivering fully compliant contracts

Contracts are more than paperwork—they’re your first line of defence in a dispute. Rivermate provides legally vetted, localized agreements for 150+ countries, covering all essential terms: scope of work, payment schedules, intellectual property transfers, and confidentiality obligations.

Image caption: Rivermate provides legally vetted, localised agreements for 150+ countries

Image caption: Rivermate provides legally vetted, localised agreements for 150+ countries

Simplifying cross-border payments

Paying contractors in multiple countries often involves juggling bank transfers, FX rates, and compliance reporting. With Rivermate, you can pay in 180+ currencies from a single ledger, benefit from automated invoicing, and get transparent currency conversion rates without hidden fees.

Image caption: With Rivermate, you can pay in 180+ currencies from a single ledger

Image caption: With Rivermate, you can pay in 180+ currencies from a single ledger

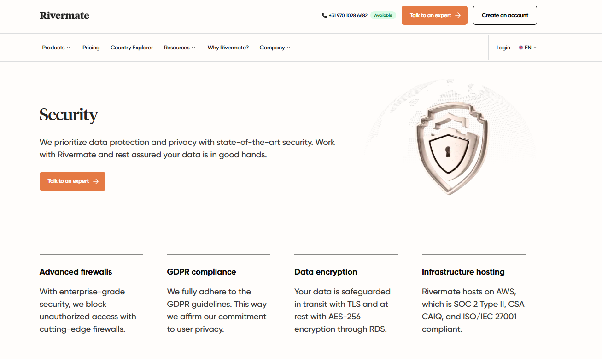

Protecting data and privacy

Image caption: Rivermate protects user data and privacy with advanced security features

Image caption: Rivermate protects user data and privacy with advanced security features

Many contractor arrangements involve handling sensitive information. Rivermate includes jurisdiction-specific data privacy clauses and Data Processing Addendums (DPAs) where required—ensuring compliance with regulations like GDPR.

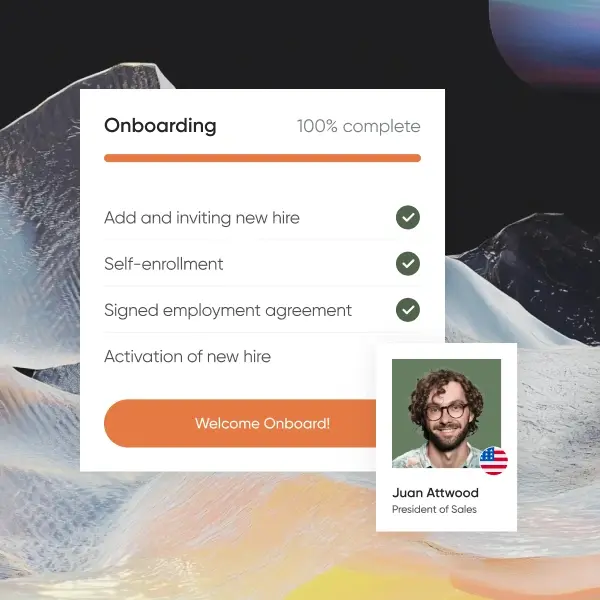

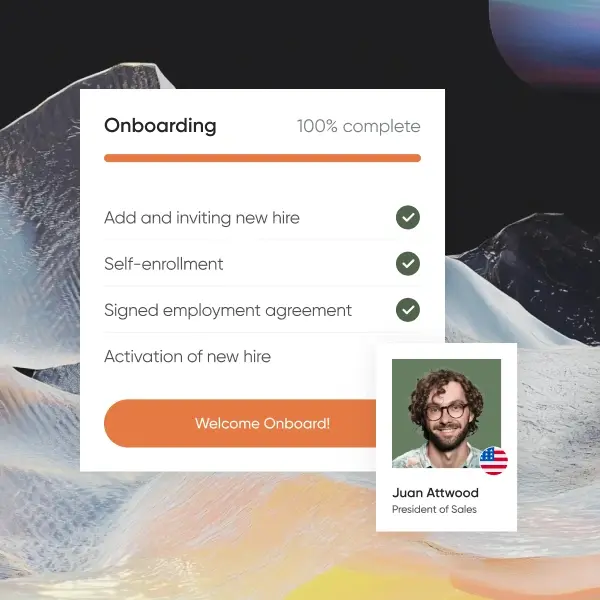

Speeding up onboarding

In traditional setups, onboarding can take weeks. Rivermate reduces that to days with self-service onboarding links that collect contractor information, generate compliant contracts, and set the stage for immediate collaboration.

Image caption: From onboarding to payroll, Rivermate's all-in-one platform simplifies every stage of employment.

Image caption: From onboarding to payroll, Rivermate's all-in-one platform simplifies every stage of employment.

Keeping documentation audit-ready

Scattered files create headaches when questions arise. Rivermate stores all contracts, tax forms, and classification evidence in one secure, centralised platform—so HR, Finance, and Legal teams can retrieve documents instantly during an audit.

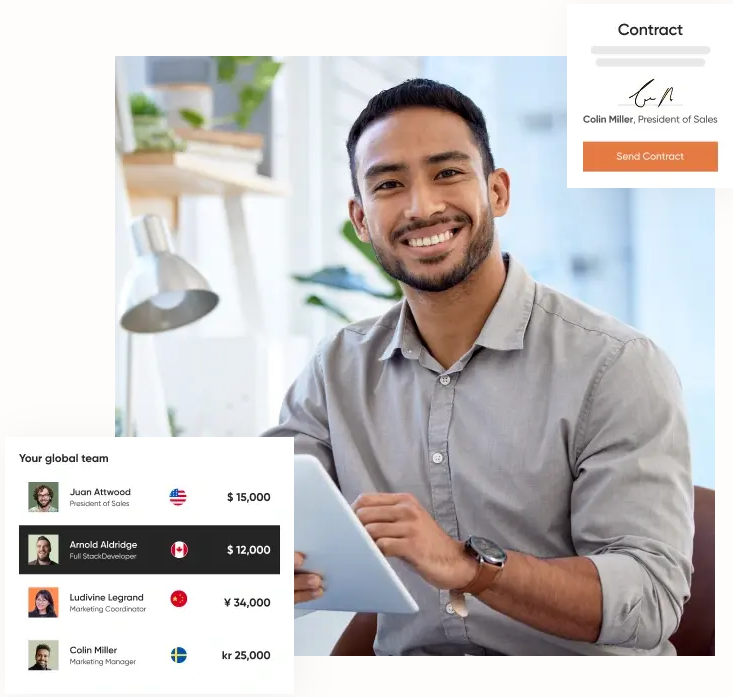

Why Rivermate is your trusted partner for compliant global contractor hiring

Hiring an independent contractor—especially across borders—offers flexibility, specialised expertise, and faster project delivery. But without the right processes, it can also expose your business to legal and financial risks. From defining the role to ensuring contracts, payments, and compliance are airtight, every step matters.

Rivermate takes on the misclassification risk by legally hiring contractors on your behalf, ensuring compliance with local laws and protecting your business from fines or legal troubles.

Its localized contracts cover country-specific clauses, tax handling, and benefits management—fully compliant and crafted by in-house experts to safeguard you against sudden regulatory changes. Rivermate manages the entire contractor lifecycle, from onboarding to payments, through a centralized platform.

If you want a hands-on experience of how Rivermate can turnaround your international contractor hiring process, book a free 30-minute consultation

FAQs

How do I determine if a worker is an independent contractor or an employee?

Look at the level of control, independence, and financial arrangement. Employees usually have set working hours, use company equipment, and are integrated into your operations. Contractors control how and when they work, can serve multiple clients, and manage their own taxes. Local laws vary, so always check jurisdiction-specific tests before hiring.

What steps should be taken to find and hire an independent contractor?

Define the role and deliverables, confirm contractor status under local law, agree on payment terms, secure IP and confidentiality protections, and draft a compliant contract. When hiring internationally, partner with a Contractor of Record to handle local compliance and onboarding.

What are the legal and contractual considerations when hiring an independent contractor?

You need a contract that clearly defines scope, deliverables, payment, IP transfer, confidentiality, and dispute resolution. Some countries also require registration, tax forms, or specific clauses to validate contractor status.

What are common mistakes to avoid when hiring and managing independent contractors?

Misclassifying a worker, using employee-style contracts, failing to protect IP, overlooking local tax rules, and not centralising compliance documents are all common missteps. Many of these can be avoided by working with an experienced global partner like Rivermate.

Image caption: Rivermate tackles this with a built-in classification engine and country-specific contracts

Image caption: Rivermate tackles this with a built-in classification engine and country-specific contracts Image caption: Rivermate provides legally vetted, localised agreements for 150+ countries

Image caption: Rivermate provides legally vetted, localised agreements for 150+ countries Image caption: With Rivermate, you can pay in 180+ currencies from a single ledger

Image caption: With Rivermate, you can pay in 180+ currencies from a single ledger Image caption: Rivermate protects user data and privacy with advanced security features

Image caption: Rivermate protects user data and privacy with advanced security features Image caption: From onboarding to payroll, Rivermate's all-in-one platform simplifies every stage of employment.

Image caption: From onboarding to payroll, Rivermate's all-in-one platform simplifies every stage of employment.