Key takeaways

- AOR supports independent contractors, managing contracts, invoices, and compliance without creating an employment relationship.

- EOR legally employs full-time workers, handling payroll, benefits, and tax obligations under local employment laws.

- AOR offers flexibility and lower cost for short-term or project-based work; EOR provides stability and full compliance for long-term teams.

- Many global companies use both models together: AOR for contractors and EOR for employees, to scale flexibly and stay compliant.

- Rivermate brings AOR and EOR together on one platform, offering transparent pricing and in-country compliance expertise across 150+ markets.

The way companies hire has fundamentally changed. They’re no longer limited by geography—teams today span continents, combining full-time employees in São Paulo with specialized contractors in Singapore. It’s an exciting shift, but also a complicated one.

Too many businesses jump into international hiring without understanding the critical differences between an Agent of Record (AOR) and an Employer of Record (EOR). The result can be compliance issues, unexpected fines, and misclassification risks that reach $100,000 per worker in some jurisdictions.

This guide explains what AOR and EOR mean, how they differ in practice, and when to use each model. Whether you’re testing a new market or scaling globally, understanding these distinctions is essential for compliant, sustainable growth.

At Rivermate, we’ve helped hundreds of companies make these decisions through a single, transparent platform that supports both AOR and EOR models.

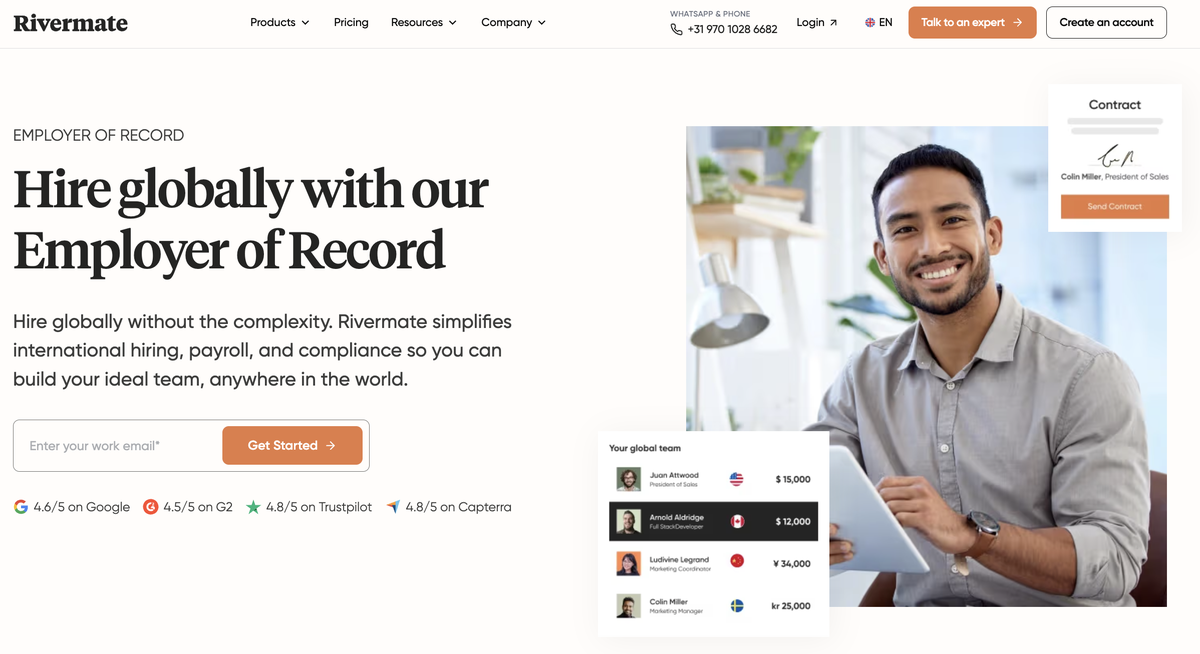

What is an Employer of Record (EOR)?

Caption: “Rivermate’s Employer of Record (EOR) service makes global hiring simple, compliant, and stress-free.”

An Employer of Record (EOR) acts as your legal employment partner in countries where your company doesn’t have a local entity. The EOR becomes the official employer for your international team members, managing all legal, administrative, and compliance responsibilities required under local law.

Here’s how it works in practice:

-

Employment contracts and onboarding

An EOR prepares locally compliant employment contracts that meet each country’s legal requirements. They handle onboarding from start to finish, ensuring every new hire has the right documentation, benefits setup, and clarity before day one.

Labor laws vary widely: France requires defined probation periods, while Brazil mandates specific severance terms. The EOR ensures every contract meets those standards.

-

Payroll and tax management

Each country has unique payroll regulations, tax withholding rules, and reporting obligations. The EOR manages all of it, so employees are paid accurately and on time while staying compliant with tax authorities.

For example, in Germany, employers must withhold income tax, solidarity surcharges, and social security contributions, calculated differently from the US or UK.

As your team expands across borders, the role of a reliable global payroll partner becomes critical to maintaining accuracy and compliance.

What is an Agent of Record (AOR)?

While an employer of record (EOR) manages employees, an agent of record (AOR) supports a different kind of worker: independent contractors. An AOR acts as an intermediary between your company and contractors around the world, ensuring every engagement stays compliant, without converting contractors into employees.

Here’s what an AOR manages:

-

Contractor classification and documentation

An AOR verifies that each worker meets the legal definition of an independent contractor in their jurisdiction. It prepares compliant agreements that clearly outline the scope of work, payment terms, and independence of the relationship.

Definitions of contractor status vary—what qualifies as independent work in the Netherlands may be seen as disguised employment in Spain.

-

Invoice and payment facilitation

International payments can be slow and expensive. The AOR simplifies this by processing invoices and paying contractors through local banking channels.

A contractor in Argentina can be paid in pesos, while a designer in Thailand receives baht, without your finance team managing multiple currency accounts or wire transfers. For organizations that later decide to convert key Thai contractors into employees, working with an Employer of Record Thailand can simplify compliant hiring, payroll, and benefits without setting up a local entity. This approach keeps your team in Thailand fully aligned with local labour laws while you continue to manage work and performance.

-

Tax documentation and compliance oversight

The AOR collects and maintains the required tax forms (such as [W-8BEN](https://www.irs.gov/pub/irs-pdf/fw8ben.pdf0 for non-U.S. contractors) and monitors ongoing compliance. It also tracks thresholds that could trigger reclassification, since, in many EU countries, exceeding certain hours or levels of control can reclassify a contractor as an employee.

What an AOR doesn’t do: provide benefits, assume employment liability, or create an employer-employee relationship. The contractor remains an independent business entity responsible for their own taxes, insurance, and operations.

Our Contractor of Record solution helps companies manage exactly these kinds of relationships while staying on the right side of local regulations.

AOR vs EOR: Key differences

Let’s look at how these two models differ in practice:

| Aspect |

AOR (agent of record) |

EOR (employer of record) |

| Worker type |

Independent contractors |

Full-time employees |

| Legal employer |

Contractor remains independent |

EOR becomes the legal employer |

| Tax responsibility |

Contractor manages their own taxes |

EOR withholds and remits taxes |

| Benefits administration |

Not included (contractors manage their own) |

Managed by EOR (health, pension, leave) |

| Compliance risk |

Misclassification risk if the relationship becomes too employee-like |

EOR assumes employment compliance risk |

| Typical use case |

Project-based or short-term specialized work |

Long-term or core team positions |

| Cost structure |

Typically $50–$200 per contractor/month |

Typically $300–$800 per employee/month |

| Flexibility |

High—easy to scale up or down |

Moderate—subject to employment laws |

Table caption: Key differences between an agent of record (AOR) and an employer of record (EOR)

When to use AOR vs EOR

The choice between an agent of record (AOR) and an employer of record (EOR) depends on the nature of your working relationship, project duration, and long-term hiring plans. Each model suits different stages of growth.

Use an AOR when:

-

Engaging specialized talent for defined projects

If you need short-term or project-based expertise, like a data scientist for a six-month analytics project or a designer for a brand refresh, AOR is the right fit. It gives you access to specialized skills without the long-term costs or commitments of employment.

-

Testing new markets before committing

When entering a new region, AOR allows you to engage local contractors to test product-market fit or explore new opportunities. You can evaluate performance and market potential before setting up a local entity or hiring employees through an EOR.

-

Scaling teams quickly and flexibly

AOR relationships can be established within one to two weeks. That speed makes it ideal for urgent projects or fluctuating workloads where flexibility is key. Contractors can be onboarded, paid, and managed compliantly through a single platform.

Use an EOR when:

-

Building long-term teams

If you’re hiring people who will work with you for the long term, treat them as employees. An EOR manages legal employment, payroll, and benefits so your core team members can work securely and compliantly from anywhere.

-

Ensuring full compliance and stability

When roles involve ongoing collaboration, fixed schedules, or use of company tools and systems, EOR is the safer and often required option. It protects your company from misclassification risk and gives employees access to local benefits.

-

Establishing a permanent presence

If your company plans to build lasting operations in a new market, an EOR helps you hire immediately while you decide whether to set up a local entity. It’s a compliant bridge for growing markets or teams of 10–20 employees before formal incorporation

Cost comparison and pricing transparency

Let's talk about cost, because global hiring decisions ultimately need to make financial sense for your business.

AOR pricing typically includes:

-

Per-contractor service fees ranging from $50-$200 per contractor per month depending on the country and service level

-

One-time onboarding costs ($100-$300 per contractor)

-

Payment processing fees (often 1-3% for currency conversion)

-

No benefits costs (contractors handle their own)

Example:

If you pay a contractor $5,000 per month, your total cost, including AOR fees, might be between $5,150 and $5,400.

EOR pricing typically includes:

-

Flat monthly rate per employee ($300-$800 depending on country complexity)

-

Setup/onboarding fees ($500-$1,500 per employee)

-

All payroll processing, tax withholding, and compliance monitoring

-

Benefits administration (health insurance, retirement, paid leave)

-

Legal support and employment risk management

Example:

If you pay an employee a base salary of $5,000 per month, your total monthly cost could range from $6,500 to $7,500, including EOR fees and statutory benefits (typically 20–35% of salary).

The hidden cost trap:

Some providers advertise low base rates but add extra charges later. Common hidden costs include:

-

Per-payroll “administration” fees ($50–$150 each)

-

Charges for benefits setup ($200–$500 per employee)

-

Currency conversion markups (2–4% on each transaction)

-

Platform access or minimum-commitment fees

-

Termination or offboarding fees

At Rivermate, we've built our model differently. Our pricing is flat-rate and transparent. There are no hidden administrative costs, currency markups, or surprise charges. What you see is what you pay, so you can forecast global hiring costs with confidence.

Should you choose AOR or EOR?

The right choice depends on how you plan to work with global talent.

-

Choose AOR if you’re engaging independent contractors for short-term or project-based work. It gives you flexibility and speed while maintaining compliance.

-

Choose EOR if you’re hiring full-time employees who will work long-term, need benefits, or fall under local employment laws. It provides structure, protection, and stability.

Both models have their place, and using the right one at the right time is what keeps your business compliant and scalable.

With Rivermate, you don’t have to choose between AOR and EOR. Our platform brings both models together under one partner, one contract, and one global compliance standard.

Book a demo to see how Rivermate simplifies international hiring, so you can grow your global team with confidence.

FAQs

1. What is the main difference between an AOR and an EOR?

An agent of record (AOR) manages independent contractors, ensuring contracts, payments, and tax documentation comply with local laws.

An employer of record (EOR) legally employs full-time workers on your behalf, managing payroll, benefits, and compliance.

2. Can a company use both AOR and EOR at the same time?

Yes. Many global businesses use an AOR for contractors and an EOR for full-time employees. This hybrid approach allows flexibility in workforce planning while staying compliant in every country.

3. Is an AOR cheaper than an EOR?

Generally, yes. An AOR costs less because it doesn’t cover employee benefits or assume employment liability. An EOR includes payroll, benefits, taxes, and compliance management, making it more comprehensive but also higher in cost.

4. How does Rivermate support both AOR and EOR models?

Rivermate combines AOR and EOR capabilities on one platform. It manages contractors through local AOR structures and full-time employees through EOR entities, covering over 160+ countries. This unified system ensures compliant hiring, predictable pricing, and seamless global workforce management.