Industry Insights and Trends

8 Velocity Global Alternatives in 2026

Explore 8 top Velocity Global (Pebl) alternatives for 2026. Compare EOR platforms by pricing, onboarding speed, support, and global hiring capabilities.

Lucas Botzen

Global Employment Guides

20 mins read

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demoSweden can be seen as an easy market to hire in, but the truth is, it is both attractive and demanding. The talent level is very high for their workforce, especially in technical and specialized roles, and most professionals are comfortable working in international teams. Unemployment is low and strong candidates rarely stay available for long, so hiring tends to move quickly or not at all.

Where companies run into trouble is the employment framework. Swedish labor law leaves little room for improvisation once someone is hired. The Employment Protection Act (LAS) sets clear expectations around job security, notice periods, and termination, and those rules are enforced.

On top of that, collective bargaining agreements apply across much of the market. In many cases, they matter more than the individual employment contract. They influence pay, pensions, working hours, and other benefits, and they can significantly change employment costs if they are overlooked.

For foreign companies without a Swedish entity, getting this wrong is easy. Payroll, tax reporting, and social contributions all require local setup, and benefits have to align with both statutory rules and collective agreements. An Employer of Record is often the practical solution.

The EOR acts as the legal employer in Sweden and handles payroll, taxes, and benefits while keeping the employment relationship compliant. This lets companies hire without setting up a local company and avoids most of the legal and administrative risk that comes with doing it themselves.

Below is a comparison of the 10 leading EOR providers -

| Provider | Starting Price | Onboarding Speed | Best For |

|---|---|---|---|

| Rivermate | €299/month | Fast (1–3 days) | Companies needing hands-on compliance support in Sweden |

| Remote | US$599/month | Fast (2–5 days) | Tech companies scaling globally |

| Deel | US$599/month | Fast (1–3 days) | Global teams needing automated compliance |

| Multiplier | ~US$400/month | Moderate (3–7 days) | SMEs needing cost-effective Sweden hiring |

| AYP Group | Custom | Moderate (5–10 days) | Companies expanding across APAC + EU |

| Oyster HR | US$699/month | Moderate (5–10 days) | Remote-first HR teams |

| Globalization Partners (G-P) | Custom | Fast (2–5 days) | Enterprises needing strong compliance |

| Pebl | ~US$399/month | Moderate (5–10 days) | Distributed mid-sized & enterprise teams |

| Skuad | US$199/month | Fast (2–5 days) | Budget-conscious startups |

| Papaya Global | US$599/month | Moderate (5–10 days) | Companies needing integrations + compliance automation |

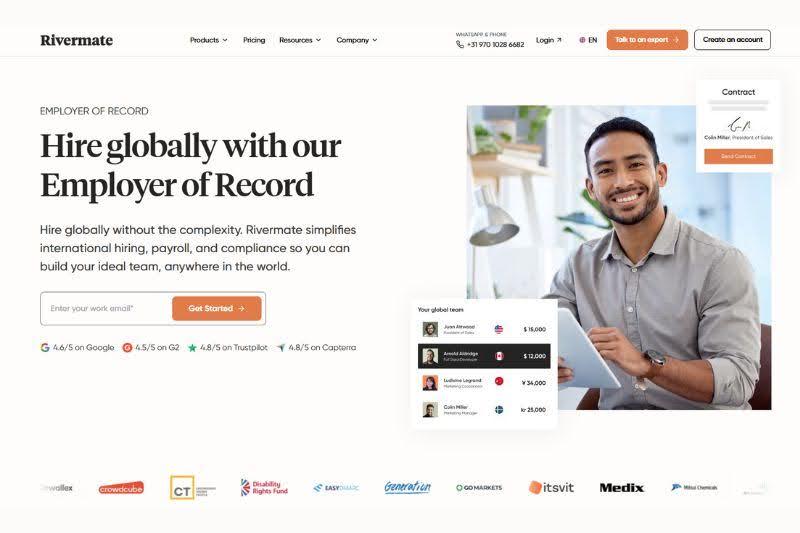

Rivermate is often the safer pick for companies hiring in Sweden for the first time. Swedish employment rules are strict, and mistakes tend to show up later, usually during terminations or contract changes. That is where Rivermate tends to perform well.

The platform focuses more on compliance and local process than on flashy features. In Sweden, that matters. Between notice periods, collective agreements, and statutory benefits, employers need things done correctly rather than quickly. Rivermate leans into that tradeoff, which makes it a good fit for teams that want stability over flexibility.

Swedish employment law leaves little room for error. Rivermate’s approach focuses on getting the fundamentals right and handling edge cases correctly.

Compliance with the Swedish Employment Protection Act (LAS)

Rivermate structures contracts, probation periods, and terminations in line with LAS requirements. Notice periods are applied correctly based on length of employment, ranging from one to six months. Terminations and contract changes follow statutory procedures, reducing the risk of disputes. Legislative updates are monitored continuously to maintain compliance.

Management of employer social security contributions

Rivermate calculates and remits the mandatory 31.42 percent employer contribution, known as arbetsgivaravgifter. These payments cover pensions, parental insurance, healthcare, and workers’ compensation. Contributions are filed and paid accurately and on schedule.

Administration of parental leave and statutory benefits

Parental leave in Sweden is generous but complex to manage. Rivermate ensures employees receive their full statutory entitlement of 480 days per child, split equally between parents. Leave usage rules, reporting obligations, and age-based restrictions are handled correctly. Sick leave and VAB for child care are also administered in line with Swedish regulations.

CBA-aligned payroll and benefits where applicable:

With approximately 90% of employees in Sweden covered by collective bargaining agreements, Rivermate reviews each role to determine whether a CBA applies and applies the correct standards for pay, overtime, leave, pensions, and other negotiated benefits. This reduces the risk of underpayment, missed pension obligations, and other compliance issues.

Sweden-compliant employment contract issuance:

Rivermate issues locally compliant Swedish employment contracts that reference applicable CBAs and meet national labor law requirements. Contracts clearly outline working hours, leave entitlements, probation periods, notice requirements, and termination conditions, helping prevent disputes and regulatory exposure.

Accurate monthly tax filing with Skatteverket:

Rivermate manages monthly payroll tax reporting with Sweden’s Tax Agency (Skatteverket), including income tax withholding and employer social contributions. All filings are calculated correctly and submitted on time, ensuring ongoing compliance without administrative burden.

G2 rating: 4.9/5

Price: €299 per employee per month

Free trial: No

Country coverage: 180+ countries

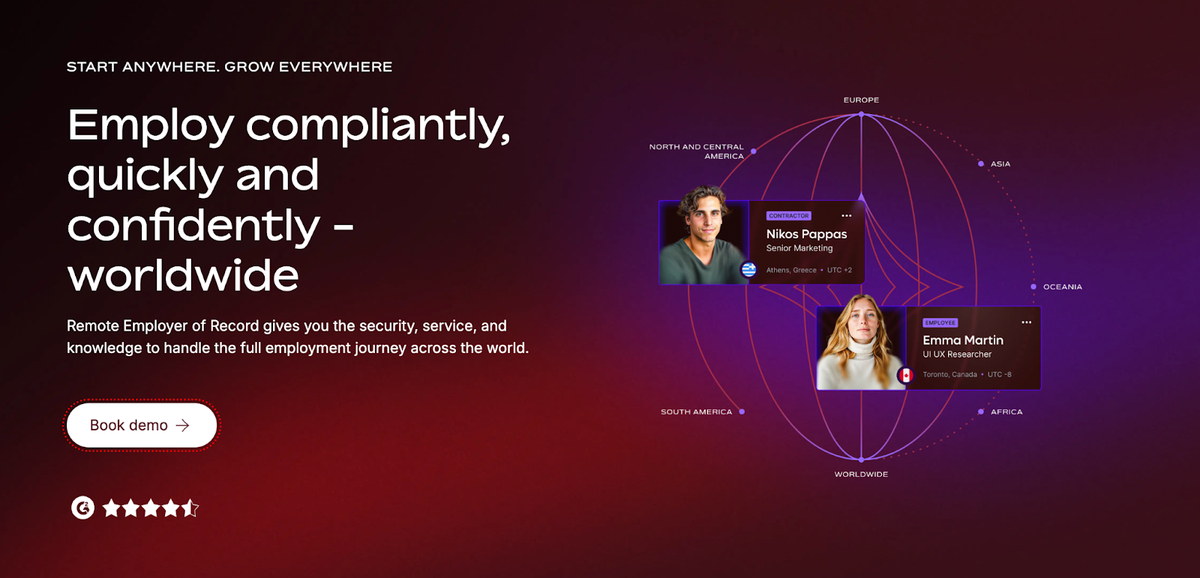

Remote is a strong fit for tech companies and fast-growing startups hiring in Sweden, particularly those that want predictable pricing without sacrificing compliance depth. The platform is well-known for its payroll accuracy, solid contractor tooling, and ability to handle Sweden’s layered tax and employment rules without heavy manual input.

With a 4.5/5 rating on G2 and a well-established Swedish payroll setup, Remote is often chosen by teams that want compliance handled “in the background” while staying cost-conscious.

Reliable Swedish payroll and tax automation

Remote automatically manages Sweden’s complex gross-to-net calculations, including municipal income tax (typically 29–35%), state income tax (20% above SEK 598,500), and the full 31.42% employer social security contribution. Payroll runs are handled accurately and on time, reducing the risk of under- or over-withholding.

Sweden-compliant employment contracts

Employment agreements are generated in line with the Employment Protection Act (LAS) and include required clauses such as probation periods (up to six months), statutory notice rules, and references to applicable collective bargaining agreements (CBAs) where relevant.

Parental leave and sick-leave coordination

Remote supports Sweden’s generous leave framework, including the 480-day parental leave entitlement. The platform tracks eligibility and usage rules (such as the 384-day requirement before a child turns four) and coordinates benefits with the Swedish social security system.

Contractor support for mixed workforces

In addition to EOR, Remote offers Contractor of Record (COR) services in Sweden. This is particularly useful for companies working with freelancers alongside employees, helping reduce misclassification risk in a market where contractor rules are closely enforced.

Built-in HR workflows

From paid leave requests to benefits enrollment, Remote’s HR tools reduce day-to-day admin while staying aligned with Swedish labor requirements.

G2 rating: 4.5/5

Price: US$599/month

Free trial: Yes

Country coverage: 170+

Deel tends to come up early when companies look at hiring in Sweden, especially if they already employ people in other countries. It is not a Sweden-first provider, but it works well when Sweden is one piece of a larger international team.

Most companies use Deel because it removes friction. Hiring can move quickly, paperwork is handled digitally, and payroll does not require deep local knowledge. For Sweden specifically, this means taxes, employer contributions, and compliance steps are handled without constant manual checks. Teams that value speed and a single global system usually find this appealing.

Deel is less about tailoring every local detail and more about keeping everything in one place. For companies scaling across multiple markets, that tradeoff often makes sense.

Fast onboarding with minimal friction: Deel typically completes Swedish employee onboarding in 1–3 days — among the fastest timelines in the EOR market. Once live, payroll runs are fully automated, covering monthly salary payments, tax withholding, and employer contributions.

Accurate tax and social security handling: Deel applies Sweden’s 31.42% employer contribution rate, calculates income tax based on municipal and state thresholds, and handles remittance to Skatteverket, helping companies stay compliant without needing local payroll expertise.

LAS-compliant digital contracts: Employment agreements are generated digitally and aligned with Swedish employment law. Contracts include required protections, notice periods, and references to collective bargaining agreements where applicable, reducing legal risk.

Benefits aligned with Swedish norms: Deel manages benefits commonly expected in Sweden, including occupational pensions (often required under CBAs), paid leave (minimum 25 days), health coverage, and parental leave coordination.

Designed for global, distributed teams: Deel’s centralized dashboard makes it easy to manage employees across Sweden and other countries from one place, with clear visibility into payroll, taxes, and compliance obligations.

G2 rating: 4.8/5

Price: US$599/month

Free trial: Demo available

Country coverage: 150+

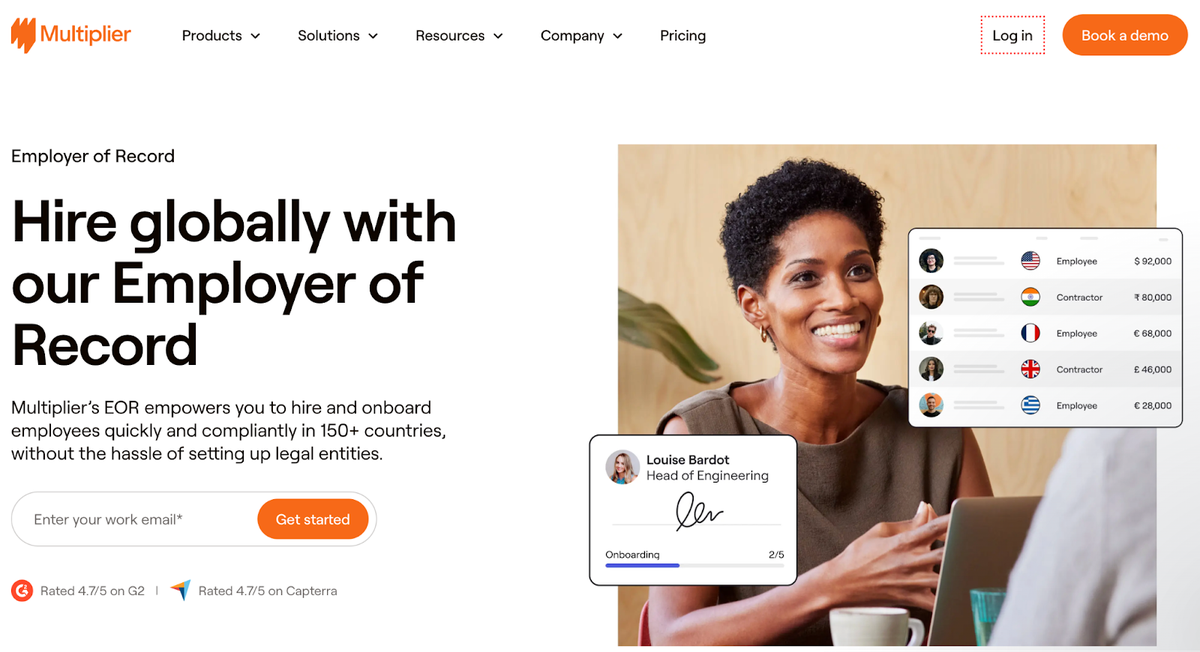

Multiplier delivers automation-first solutions with strong Sweden coverage and cost-effective pricing. With a 4.6/5 G2 rating and operations in 150+ countries, Multiplier appeals to SMEs seeking transparent, affordable global hiring.

Sweden payroll & employer contribution compliance: Running payroll in Sweden means getting employer contributions and tax reporting exactly right. Multiplier takes care of the 31.42% employer social security contributions, applies the correct income tax rates, and handles reporting to Skatteverket, so companies don’t have to manage local filings themselves.

Support for parental leave and sick pay processes: Parental leave and sick pay are standard in Sweden, but administering them can be time-consuming. Multiplier supports employers through these processes, including benefit calculations and statutory requirements, while ensuring terms align with applicable collective bargaining agreements (CBAs).

Automated contract creation: Multiplier creates LAS-compliant employment contracts in minutes. Each contract includes the required statutory clauses and reflects relevant CBAs, helping companies hire quickly without relying on external legal reviews for every new employee.

Cost-effective pricing: Multiplier uses a straightforward pricing model of roughly $400 per employee per month. There are no separate setup, onboarding, or termination fees, which makes costs easier to forecast—especially for teams hiring in Sweden for the first time.

G2 rating: 4.6/5

Price: ~US$400/month

Free trial: Yes

Country coverage: 150+

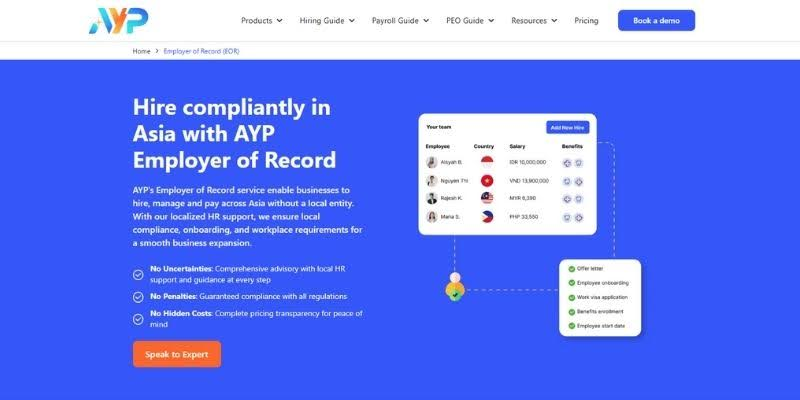

AYP Group specializes in APAC + EU compliance with growing Nordic coverage. With a 4.6/5 G2 rating and deep regional expertise, AYP is ideal for companies expanding across multiple Asian and European markets simultaneously.

Local expertise and compliance knowledge: AYP's in-country Nordic teams understand LAS nuances, CBA landscapes, and tax requirements, providing strategic guidance beyond transactional compliance.

Payroll accuracy for Sweden employer contributions: AYP correctly calculates and remits the 31.42% employer contribution and all tax withholdings to Skatteverket.

HR support across APAC + Europe: For companies hiring across Asia and Europe, AYP provides unified support, reducing complexity of managing multiple EOR relationships.

Good for regional expansion: If Sweden is part of a broader Nordic or European hiring strategy, AYP's regional expertise simplifies multi-country coordination.

G2 rating: 4.6/5

Price: Custom

Free trial: No

Country coverage: APAC + selected EU

Oyster HR is a B Corp-certified platform focused on remote-first teams and global hiring simplicity. With a 4.8/5 G2 rating and operations in 180+ countries, Oyster combines ease of use with strong compliance.

Sweden-compliant contract workflows: Oyster generates LAS-compliant contracts with references to CBAs, statutory leave, and notice terms, streamlining the hiring process.

Easy UI for remote teams: Oyster's platform is designed for remote-first companies, with intuitive dashboards for onboarding, payroll, and leave management—ideal if your team is distributed.

Strong documentation + hiring guides: Oyster publishes detailed Sweden hiring guides covering local labor laws, leave, payroll breakdown, and CBA requirements, helping HR teams upskill.

Reliable payroll and benefits handling: Their Sweden EOR services include accurate payroll calculations, tax withholding, employer contributions, and benefits administration aligned with Swedish standards.

G2 rating: 4.8/5

Price: US$699/month

Free trial: Yes

Country coverage: 180+

G-P is an enterprise EOR leader recognized for deep legal infrastructure and strong compliance. With a 4.5/5 G2 rating and operations in 180+ countries, G-P is purpose-built for large organizations with complex global hiring needs.

Enterprise-level compliance: G-P maintains large in-country legal teams across Sweden and Europe, ensuring sophisticated compliance management for complex employment scenarios, multi-country policies, and regulatory changes.

Large Sweden and EU legal teams: For international companies with thousands of employees, G-P's dedicated compliance teams provide white-glove service and strategic HR guidance.

Very strong global coverage: With 180+ countries, G-P supports truly global organizations needing unified compliance infrastructure.

Reliable benefits administration: G-P manages occupational pensions, health insurance, statutory leave, and CBA-aligned benefits across Swedish and international standards.

G2 rating: 4.5/5

Price: Custom

Free trial: No

Country coverage: 180+

Pebl is a modernized EOR platform rebranded from Velocity Global, emphasizing AI-driven hiring and global workforce management. With operations in 185+ countries, Pebl offers competitive pricing and strong compliance infrastructure.

Compliance with Swedish labor law: Pebl generates LAS-compliant contracts and manages payroll, tax withholding, employer contributions, and statutory benefits aligned with Swedish regulations.

Support for contractor + employee hiring: Pebl's unified platform handles both full-time employees and independent contractors, reducing administrative complexity for mixed workforces.

Wide global reach: With 185+ countries, Pebl supports companies with truly global ambitions, including emerging markets.

24/7 support: Pebl offers round-the-clock customer support, helpful for companies with international teams across time zones.

G2 rating: 4.2/5

Price: ~$399/month (promotional); typically $599+

Free trial: No

Country coverage: 185+

Skuad usually comes up when the conversation turns to cost. If you’re hiring in Sweden but don’t want to commit to enterprise-level EOR pricing, it’s often one of the first platforms people compare. The appeal is straightforward: it keeps monthly costs low while still covering contracts, payroll, and local compliance without requiring much manual involvement.

For early-stage teams or companies hiring their first employee in Sweden, that trade-off is often acceptable. You get a working EOR setup quickly, without paying for features you’re unlikely to use in the short term.

G2 rating: 4.7/5

Price: US$199/month

Country coverage: 160+

Papaya Global sits at the opposite end of the spectrum from budget EORs. It’s built for companies that already operate across multiple countries and need deep payroll control, reporting, and system integrations rather than speed or simplicity.

Papaya integrates tightly with enterprise systems like SAP, Workday, and NetSuite, which is a major plus for larger organizations. The trade-off is complexity. Setup takes longer than lightweight EOR platforms, and smaller teams often find the interface more than they actually need.

G2 rating: 4.5/5

Price: US$599/month

Country coverage: 160+

By 2026, most Swedish tech employees won’t be asking whether flexible work is allowed. They’ll assume it is, and they’ll pay attention to whether it actually holds up when things get busy. People are used to managing their own time, and they’re quick to notice when flexibility disappears under deadlines or pressure. When that happens, trust erodes fast, even if compensation is strong.

Candidates also read a lot into this phase. A slow onboarding process is often taken as a signal of how the company operates internally. If paperwork takes days to finalize, people assume decisions will be slow once they join. This is especially true for international employers, where candidates already expect some complexity. Sweden’s faster permit processes help, but only if the company itself is ready to move. When onboarding drags, confidence drops, and that is usually when candidates walk away.

By 2026, most Swedish tech employees will not ask whether flexible work is allowed. They will assume it is. What they pay attention to instead is whether that flexibility survives busy periods. People are used to managing their own time and output, and they notice quickly when trust disappears under deadlines. When flexibility exists only on paper, it tends to damage credibility rather than improve it.

Employees also value clarity more than big promises. They want to understand how progression works, how salaries are reviewed, and what a normal workload actually looks like. High pay alone does not offset uncertainty or constant urgency. In sectors where collective agreements apply, those terms are generally accepted as the baseline. Companies that succeed in Sweden are often not the loudest or most ambitious, but the ones that feel stable, fair, and consistent over time.

Sweden is not a market where you can afford to “figure it out later.” Employment terms are rigid, collective agreements are common, and once someone is hired, unwinding mistakes is slow and expensive. If your EOR treats Sweden like just another country on a pricing sheet, that is a risk.

What matters most is judgment. An EOR should tell you when a role triggers a collective agreement, push back on contract terms that will cause problems, and explain the real consequences of notice periods and terminations under LAS. Payroll accuracy is table stakes. Practical guidance is what separates a safe hire from a costly one.

Speed still matters, but not at the expense of correctness. In Sweden, onboarding fast only helps if everything is done properly from day one. The right EOR lets you move quickly without cutting corners, hire employees with confidence, and build a team that will actually last.

Learn how Employer of Record services work in Sweden with Employer of Record in Sweden: A Quick Glance, covering employment laws, compliance requirements, and local hiring essentials.

What does an EOR do in Sweden?

In simple terms, the EOR is the legal employer in Sweden. They put the employee on their books, issue a Swedish contract, and run payroll. They also handle taxes, employer contributions, and required benefits, and deal with Skatteverket. You still decide what the person works on and how their role is run. The EOR just carries the legal responsibility.

How fast can I hire an employee in Sweden through an EOR?

If everything is straightforward, it can be very quick. A local Swedish hire with no visa needs can sometimes start within a few days. In other cases, it takes closer to a week. Delays usually come from missing documents, collective agreements, or work permits. Compared to opening a local entity, it is still much faster.

Do I still manage my employee's work if an EOR employs them?

Yes. You manage the employee like you normally would. You assign work, set priorities, and review performance. The EOR does not tell the employee what to do. They handle payroll, contracts, and compliance only.

How much does an EOR cost in Sweden?

It depends on the provider and the level of support. Some prices start around US$199 per month, but most companies pay more than that. A typical range is US$400 to US$700 per employee each month. That usually includes payroll, taxes, and standard benefits. Things like visas or extra local HR support are often charged separately.

What employer taxes and contributions apply in Sweden?

Employers pay approximately 31.42% in mandatory employer contributions, covering pensions, healthcare, parental leave, and other social insurance. Employers also withhold income tax from salaries and report everything to Skatteverket every month. Tax rates vary by municipality, and higher salaries are subject to state income tax as well.

Do EORs handle CBAs and Swedish employee protections?

Yes, and this part matters. A good EOR checks whether a collective bargaining agreement applies and follows it. CBAs are common in Sweden and affect pay, working hours, leave, pensions, and termination terms. Employment is also covered by the Employment Protection Act, which sets strict rules around notice periods and dismissal. Missing this can cause real problems.

Lucas Botzen is the founder of Rivermate, a global HR platform specializing in international payroll, compliance, and benefits management for remote companies. He previously co-founded and successfully exited Boloo, scaling it to over €2 million in annual revenue. Lucas is passionate about technology, automation, and remote work, advocating for innovative digital solutions that streamline global employment.

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demo

Industry Insights and Trends

Explore 8 top Velocity Global (Pebl) alternatives for 2026. Compare EOR platforms by pricing, onboarding speed, support, and global hiring capabilities.

Lucas Botzen

Industry Insights and Trends

Looking for an Oyster HR alternative? Explore the best EOR platforms for fast onboarding, compliant hiring, global payroll, and benefits administration.

Lucas Botzen

Employee Benefits and Well Being

How long is maternity leave in the US? Learn the legal minimums, paid vs unpaid leave, state differences, and employer obligations for new parents.

Lucas Botzen