TL;DR:

- What is global payroll compliance?: It involves adhering to tax laws, labor regulations, and data privacy standards in different countries.

- Why is it important?: Non-compliance can result in fines, legal risks, and reputational damage.

- Common challenges: Varying pay cycles, currency fluctuations, and evolving local laws complicate global payroll management.

- How to manage payroll compliance?: Use global payroll software, partner with a global payroll provider, or rely on Employer of Record (EOR) services.

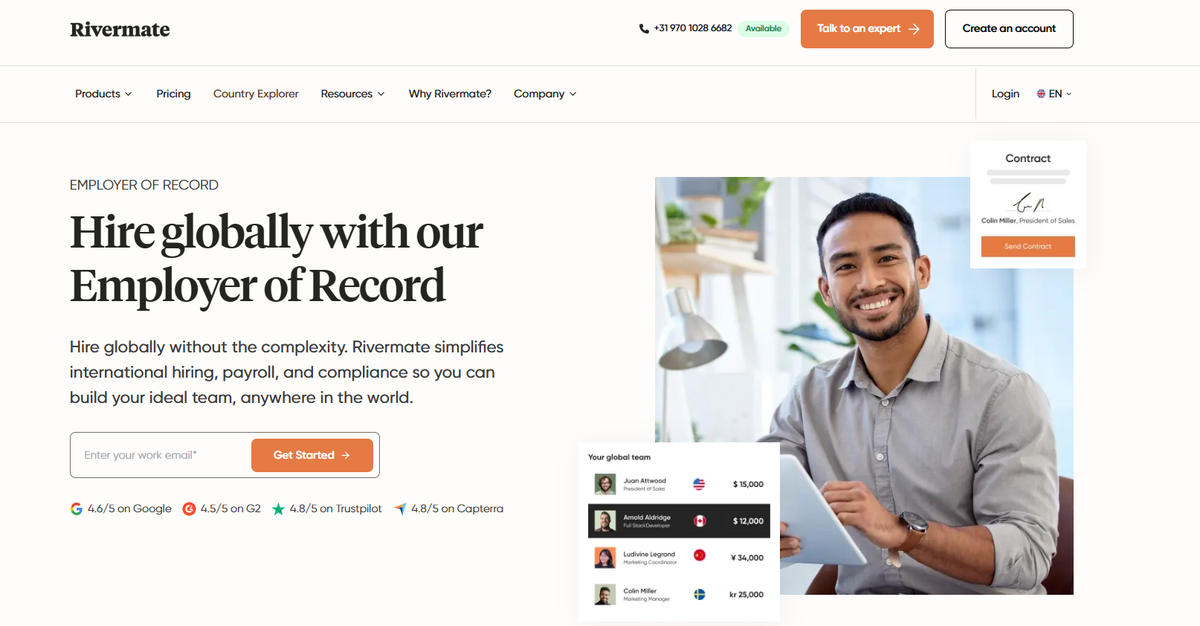

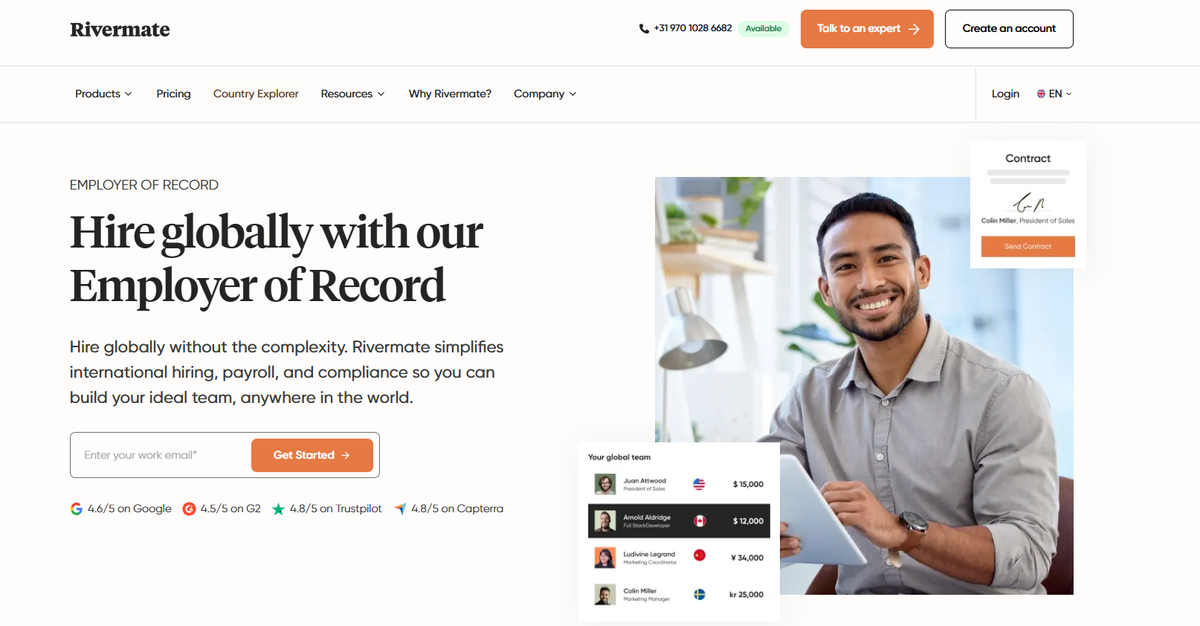

- Rivermate’s role: Rivermate simplifies global payroll compliance by handling country-specific regulations, payroll processing, and legal support in 150+ countries.

What Is Global Payroll Compliance? A Complete Guide in 2026

Managing payroll across borders is a challenge that even experienced teams struggle with. In a 2024 industry survey of over 600 global payroll professionals, 63% identified compliance as their biggest hurdle, while 41% admitted they do not track global payroll performance, highlighting how easily complexity can overwhelm even seasoned payroll teams.

From navigating varying tax laws and labor regulations to managing benefits in multiple countries, missing a single requirement can lead to fines, delays, or costly errors.

For mid-market companies expanding internationally, these challenges can slow growth and strain internal resources.

Fortunately, global payroll compliance doesn’t have to be a constant source of stress. By partnering with the right global payroll provider, like Rivermate, businesses can streamline their payroll processes, mitigate risks, and ensure legal peace of mind across borders.

In this guide, we’ll explore the importance of global payroll compliance, the risks involved, and how businesses can navigate the complexities of international payroll.

What is global payroll compliance?

Global payroll compliance is about ensuring that your business meets local labor, tax, and data protection laws in each country where you hire employees or contractors. Navigating these laws can be complex, especially when you're managing teams across different jurisdictions, each with its own set of rules.

In simple terms, global payroll compliance covers:

-

Tax regulations: Making sure your employees' wages are taxed correctly and that your business fulfills its tax obligations

-

Labor laws: Following local rules on working hours, wages, paid leave, and employee rights

-

Statutory benefits: Providing required employee benefits like healthcare or pension contributions, which vary by country

-

Data privacy: Ensuring employee data is handled securely, in compliance with regulations such as GDPR

-

Worker classification: Correctly classifying workers as employees or contractors to avoid costly misclassification issues

As businesses scale globally, staying on top of these rules becomes increasingly difficult. But with the right partner, compliance becomes less of a challenge, helping you focus on what matters most: growing your business.

Why is global payroll compliance so complex and challenging?

Caption: Five reasons why global payroll compliance is challenging

Managing global payroll compliance is like juggling multiple moving parts, and here’s why it feels overwhelming for many businesses:

-

Diverse local laws and regulations

Each country has its own unique set of rules. What’s required in one country—say, healthcare contributions or paid leave policies—may be completely different in another.

For example, businesses hiring in the EU must follow GDPR, protecting employee data and maintaining strict privacy standards. In the U.S., the focus is on accurate tax withholding and reporting, while in Australia, employers must handle mandatory pension contributions under the Superannuation Guarantee.

Trying to stay on top of all these different legal requirements can easily overwhelm a small team.

-

Constantly evolving regulations

Local payroll laws aren’t static. They change regularly, and missing an update can lead to fines, delays, or worse.

For example, in 2026, the [U.S. increased the Social Security wage base] and tightened reporting deadlines, while new rules redefined employee classification.

What was compliant yesterday might be outdated today, making it essential for your team to monitor every regulatory change in every market where you operate.

Not every business has the time or resources for this. Missing an update can quickly become costly.

-

Currency and exchange volatility

Paying employees in different currencies introduces another layer of complexity. Exchange rates can fluctuate, causing discrepancies in payroll.

A payment that was accurate today may not be accurate tomorrow. This can lead to employee frustration or tax issues that are hard to resolve without local expertise.

-

Misclassifying workers: a hidden risk

What starts as a simple decision—contractor or employee—becomes more complex as laws around classification vary dramatically from country to country. Misclassifying a worker can lead to back taxes, penalties, and even lawsuits.

It’s not only about filling out paperwork correctly; it’s about understanding each country’s nuanced labor rules。

| Did you know? Hiring employees or contractors in another country can trigger a permanent establishment risk, which may create unexpected tax obligations and regulatory responsibilities beyond payroll. These risks can be costly if overlooked, affecting both your budget and compliance standing. With the right global payroll partner, like Rivermate, you can manage these complexities confidently, protecting your business from fines and keeping your global hiring strategy on track. |

-

Time-consuming and resource-intensive

Global payroll is a full-time job. To stay compliant, you need dedicated teams, or a network of trusted providers, to handle everything from local payroll processing to managing benefits and tax filings. For many growing companies, this is simply too much to handle internally.

This is where Rivermate steps in. With our in-country expertise and technology-driven solutions, we help businesses navigate these challenges, ensuring compliance in 150+ countries. We take care of the complexity, so you don’t have to.

Common risks of global payroll compliance

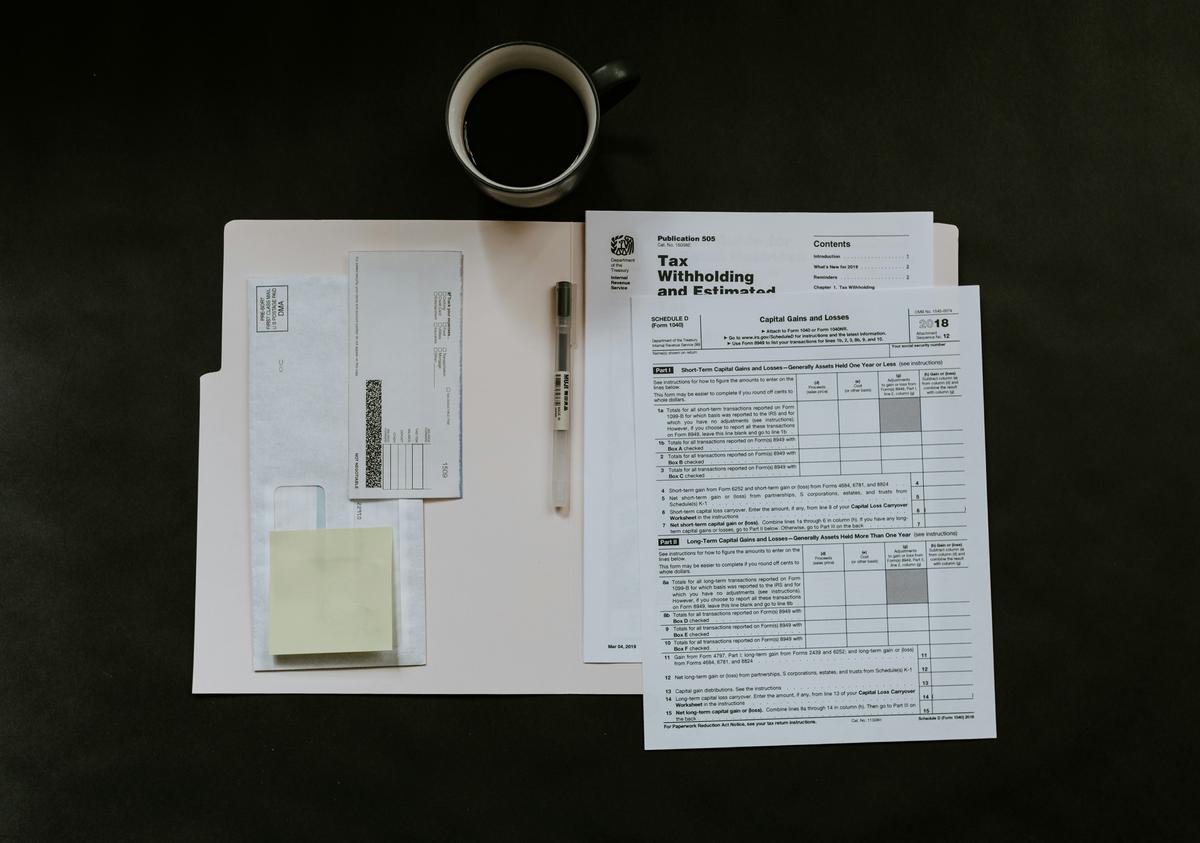

Caption: Visual representation of tax filing forms

Managing payroll across multiple countries involves more than just making sure employees are paid on time. There are real risks that can arise from non-compliance, and these can have far-reaching consequences.

Here’s a look at the most common risks businesses face when handling global payroll:

-

Fines and penalties

If your company fails to comply with local tax laws or labor regulations, you could be subject to significant fines and penalties. For example, in countries like France or Germany, missing a tax deadline can result in hefty late fees, sometimes amounting to thousands of dollars.

These fines can quickly add up and tarnish your company’s reputation with local authorities.

According to an April 2025 report, missing the tax payment deadline in France triggers an automatic 10% penalty on the tax owed, plus 0.20% interest per month of delay.

German tax rules specify that a late payment penalty (Verspätungszuschlag) of 0.25% of the tax owed per month applies, with a minimum charge of €25 for each month started. For larger payrolls, these penalties can quickly reach thousands of euros. In cases of repeated non-compliance or significant unpaid amounts, fines can escalate to up to €25,000.

-

Legal action from employees

Failure to adhere to labor laws—whether it’s misclassifying workers or not providing the required benefits—can lead to legal action from employees.

This could range from claims for unpaid wages or benefits to full-blown lawsuits. In some cases, employees may seek damages for their employer’s failure to comply with local laws, costing both time and money.

Take for example, Scale AI, a major AI startup valued at $13.8 billion, that faced legal scrutiny over worker classification.

Former employee Amber Rogowicz filed a lawsuit in California in January 2025 alleging she and other workers were misclassified as independent contractors, rather than employees, while performing essential tasks such as labeling data and reviewing AI outputs. The claim highlights unpaid hours, wage violations, and missing protections like overtime and sick leave.

-

Reputational damage

Non-compliance doesn’t just hurt financially. It can also damage your company’s reputation. For businesses that are actively hiring or expanding, news of a compliance issue can spread quickly and erode trust with potential employees and customers.

In the competitive global marketplace, this loss of credibility can have long-term consequences on growth.

-

Operational delays

Managing payroll compliance can be time-consuming.

If a business is relying on outdated systems or trying to handle multiple countries’ payroll manually, it increases the risk of operational delays. Late payments, missed deadlines, and incorrect tax filings can disrupt operations, lower employee morale, and cause friction with local authorities.

-

Difficulty managing complex payroll systems

The complexities of handling payroll for employees in different countries can result in confusion or errors.

For example, tax brackets, deductions, and payroll frequencies vary, which can make it hard for businesses to process payments correctly across borders. Even the smallest error in payroll can lead to significant tax liabilities or compliance failures.

-

Unpredictable costs

Without clear visibility into the full cost of payroll in different countries—taking into account taxes, benefits, and statutory requirements—businesses may face budget overruns.

Hidden costs, such as tax liabilities or mandatory benefits in specific countries, can lead to unexpected financial strain. Accurate forecasting becomes nearly impossible if payroll processes aren’t centralized or managed properly.

How to avoid payroll compliance risks

Avoiding the risks associated with global payroll compliance requires proactive planning, the right tools, and expert support. Here’s how you can minimize the chances of non-compliance and keep your global payroll operations running smoothly:

-

Partner with an employer of record

Caption: Rivermate’s employer of record solution

One of the most effective ways to avoid compliance issues is to partner with an Employer of Record (EOR) like Rivermate. An EOR handles all aspects of global payroll compliance, including tax filings, benefits administration, and labor law requirements.

By outsourcing these responsibilities, you can ensure that all payroll-related processes comply with local regulations, reducing the risk of fines or legal action.

-

Centralize payroll management

Centralizing your payroll management allows for better oversight and consistency across countries. Instead of having separate teams handling payroll for each country, centralizing payroll data into one system provides a clearer view of compliance across your entire operation.

This reduces errors and ensures that you can spot potential issues before they become costly mistakes.

-

Stay updated on local regulations

Global payroll compliance is constantly evolving. Laws change, tax rates fluctuate, and new labor regulations emerge regularly. It’s essential to stay up to date with these changes to avoid falling behind. Working with an international payroll compliance provider that actively monitors changes to local laws in real-time can give you peace of mind that your business is always compliant.

-

Leverage payroll software with compliance features

Investing in payroll software that includes compliance management tools is crucial. Modern payroll systems can automate tax calculations, benefits deductions, and report generation. Some systems also integrate with global employment platforms like Rivermate, offering a seamless solution for tracking compliance and ensuring that you stay ahead of any regulatory shifts.

-

Conduct regular compliance audits

It’s not enough to just manage payroll on an ongoing basis. You should also regularly audit your processes to ensure they remain compliant. A compliance audit will help identify gaps, mistakes, or outdated practices that could lead to issues down the line. Regular reviews can help you maintain accuracy and avoid surprises.

-

Train your HR and payroll teams

Your HR and payroll teams are the frontline defense against payroll compliance risks. Regular training on local labor laws, tax regulations, and employee benefits requirements is essential to ensure they’re well-equipped to handle the complexities of global payroll.

Empowering your teams with the knowledge they need can prevent mistakes and help them act swiftly in the face of regulatory changes.

-

Work with local experts

Relying on in-country experts can be invaluable. Local payroll and tax experts understand the nuances of their country’s laws, making them the best resource for ensuring compliance. Rivermate, for instance, offers local expertise in 150+ countries, so you never have to navigate complex regulations on your own.

How Rivermate helps in navigating global payroll compliance

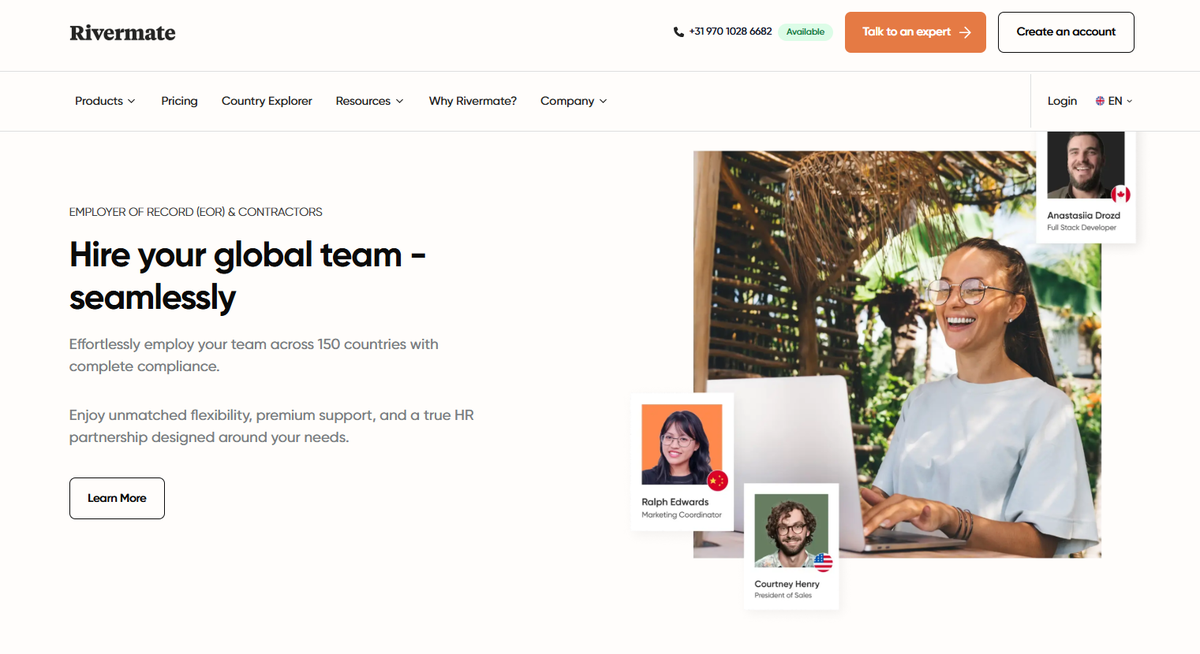

Caption: Rivermate offers employer of record and contractor of record solutions

Managing global payroll compliance is complex, but with Rivermate, you have a trusted partner that simplifies the process and ensures compliance in over 150 countries.

Here’s how Rivermate supports your business in staying compliant, reducing risks, and streamlining payroll:

-

Global Employer of Record (EOR)

Caption: Rivermate’s employer of record solution

Rivermate’s EOR service lets you hire employees in multiple countries without the need for setting up local entities. This means you can expand into new markets quickly and compliantly, with all payroll, tax filings, and benefits handled by in-country experts.

Rivermate takes care of the local employment laws, ensuring full compliance and minimizing your risk of legal issues.

Caption: Hightekers client testimonial

-

Contractor of Record (COR)

Caption: Rivermate’s contractor of record solution

Per le aziende che gestiscono contractor a livello globale, il [COR] di Rivermate garantisce che tutti i contractor siano correttamente classificati e conformi alle leggi locali.

I rischi di misclassification sono ridotti al minimo, poiché Rivermate gestisce contratti, pagamenti e obblighi legali dei contractor. Questo servizio fornisce una struttura chiara per coinvolgere lavoratori indipendenti in qualsiasi paese, semplificando la scalabilità della forza lavoro senza sorprese legali.

-

Gestione completa della payroll

Rivermate semplifica l'elaborazione della payroll in oltre 150 paesi con sistemi automatizzati che gestiscono le aliquote fiscali locali, i benefit dei dipendenti e le detrazioni statutarie.

Riceverai una fattura mensile unica (in USD, EUR o GBP), indipendentemente dal numero di paesi in cui operi, risparmiando tempo e riducendo la complessità di gestire più provider di payroll.

Caption: Boloo testimonial cliente

-

Onboarding personalizzato

Ogni dipendente che assumiamo o trasferiamo per conto dei nostri clienti riceve una sessione di onboarding dedicata. Questo va oltre la nostra presenza globale e supporto pratico, offrendo un livello di guida che i concorrenti non forniscono.

Durante la sessione,

- Spieghiamo le basi di EOR e chiarifichiamo i ruoli di tutti

- Facciamo una demo dal vivo del dashboard Rivermate

- Mostriamo