TL;DR

-

Modular pricing can be costly: Rippling’s pricing starts with a base plan ($8 per employee/month), but most global features—like EOR services or international payroll—are add-ons. These extras significantly increase the total cost as your team scales internationally.

-

EOR costs add up fast: Rippling charges $1,000/month per employee for Employer of Record services in countries where you don’t have an entity. Global payroll adds another ~ $200/month per international employee.

-

Hypothetical calculations show steep monthly totals:

-

A 50-person team with 10 global hires could pay over $12,000/month

-

A 20-person team with 5 global hires might pay $6,000+/month

These totals don’t include hidden charges or region-specific surcharges.

-

Hidden fees and usage-based billing: Costs fluctuate based on employee count, location, and feature usage. Additional charges may apply for visa support, custom benefits, or even contractor management—often not clearly disclosed upfront.

-

Region-based pricing can be confusing: Prices vary based on local tax laws and labor complexity. For example, hiring in Germany or Japan could be significantly more expensive than hiring in Portugal or Mexico, where partnering with an Employer of Record Portugal helps you keep costs predictable while staying compliant.

-

Rippling is best suited for teams with simple, domestic needs: While it’s flexible and scalable for certain setups, its complexity and pricing unpredictability can be a burden for growing international teams.

-

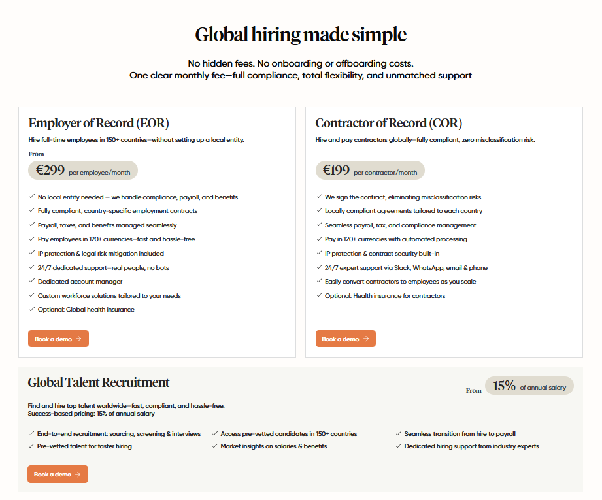

Why companies switch to Rivermate:

-

Flat, all-inclusive pricing: One predictable fee per employee—no add-ons for EOR, payroll, visas, or compliance across 150+ countries.

-

Real human support: 24/7 access to legal and HR experts via Slack, WhatsApp, or email—no bots, no queues.

-

Mid-market focus: Ideal for teams hiring 10–15 employees per country, with legal, HR, and finance support built in.

-

Faster, flexible onboarding: Custom workflows, local benefits, and employee setup in under 48 hours.

-

Embedded partnership: Rivermate integrates with your team to support long-term growth—not just software.

A Complete Guide to Rippling Pricing: What to Expect in 2026

Hiring across borders has never been easier, but understanding what you'll pay for it? That’s a different story.

For many companies evaluating global workforce tools, Rippling’s pricing seems simple at first glance, but quickly reveals layers of modular add-ons, usage-based billing, and region-specific costs that can be difficult to predict.

As businesses grow, these complexities can lead to misaligned budgets, surprise fees, or stalled hiring due to underestimated total cost of ownership.

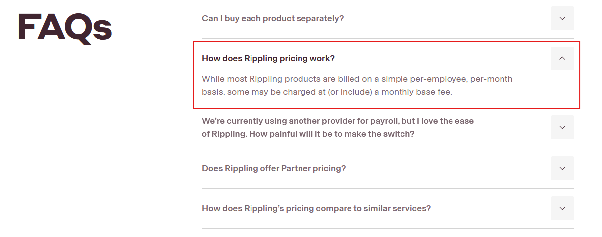

Rippling pricing user review from G2

Rippling pricing user review from G2

Whether you're exploring Rippling payroll pricing, adding EOR (Employer of Record) services, or just trying to answer “how much does Rippling cost per month?”, it’s not always clear what’s included—and what’s extra.

That’s why we’ve created this guide.

In the sections that follow, we’ll break down Rippling’s pricing plans for 2026, explore how its modular structure impacts your bottom line, and highlight where hidden costs often creep in. We’ll also show how Rivermate compares as a global employment partner, helping you make a more confident, cost-effective decision.

Rippling pricing breakdown by plan and module

Rippling’s cost structure isn’t a one-size-fits-all solution. It offers a modular pricing model, meaning businesses can choose the features they need based on the size of their teams and the services they require.

However, this flexibility can quickly become overwhelming if you’re not clear on what’s included in each plan.

1. Base plan: essentials for HR and payroll

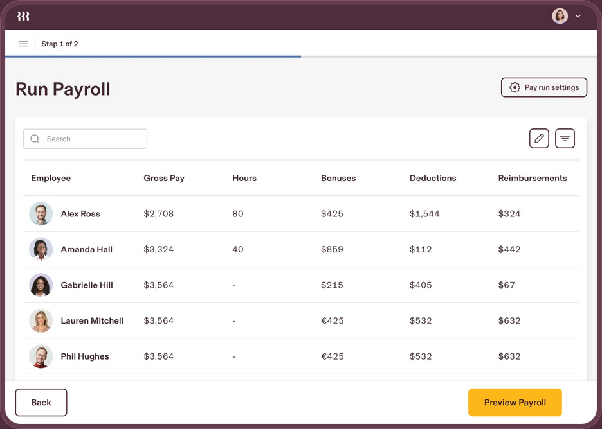

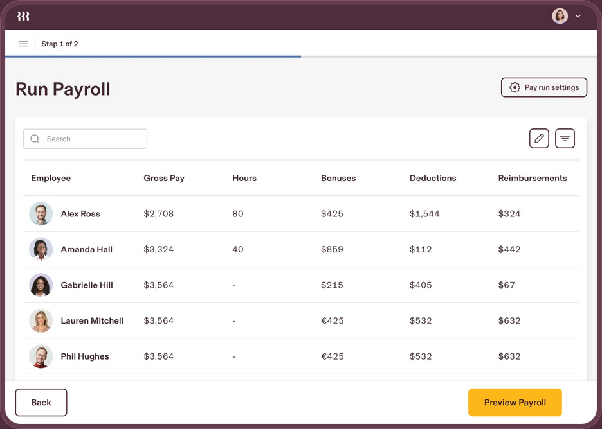

At the core, Rippling’s base pricing covers essential HR and payroll services. This includes features such as employee management, payroll processing, and standard benefits administration.

However, businesses often find that the base plan doesn’t address their full set of needs, especially when operating in multiple countries or managing contractors.

Caption: Rippling’s HCM module offers payroll processing and management

Key inclusions in the base plan:

- Employee onboarding

- Payroll processing in the US and select international locations

- Benefits management

- Time and attendance tracking

2. Add-ons: enhancing global capabilities

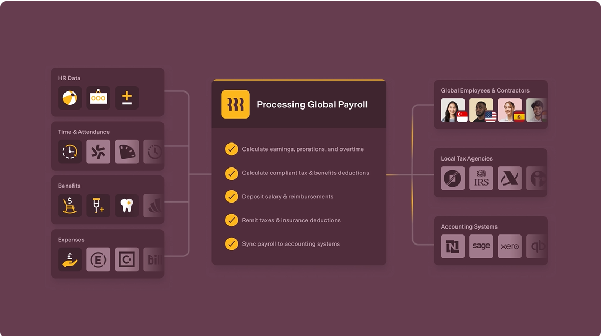

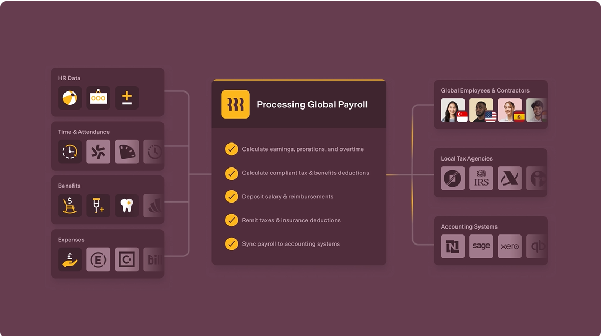

As your global footprint expands, so do the costs. To scale internationally, you’ll need to add features like EOR services for managing employees in different countries, or global payroll to ensure tax compliance across borders.

Common add-ons and their costs include:

- Global payroll: For companies managing employees outside of the U.S., global payroll processing becomes a necessity. Each country comes with its own unique pricing structure, which varies depending on local regulations and tax laws.

Caption: Rippling’s pricing plan for global payroll

- EOR services: If you’re hiring employees in countries where you don’t have a legal entity, Rippling’s EOR services let you hire and onboard employees compliantly, managing payroll, taxes, and benefits in each region.

Caption: Rippling EOR pricing 2026

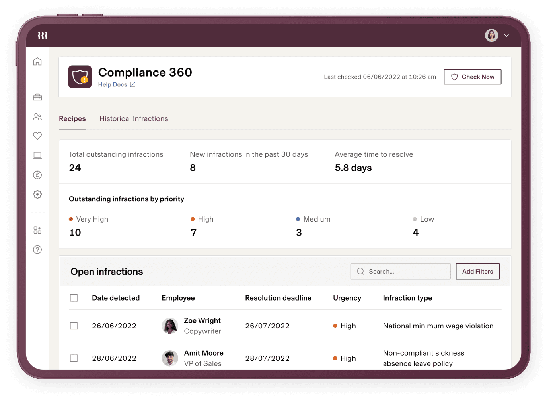

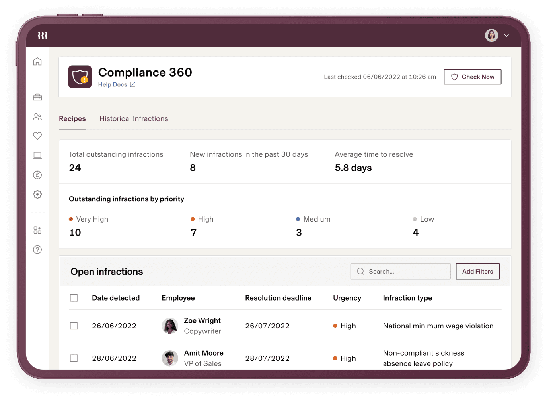

- Compliance Tools: Additional tools help with labor law compliance in different countries, which could also come with their own fees depending on the complexity of the legal requirements in those countries.

Caption: Rippling’s pricing plans w.r.t compliance

3. Custom solutions: tailored for large enterprises

For mid-market and enterprise companies, Rippling offers custom solutions that allow businesses to integrate a wider array of services—like custom benefits packages, dedicated support, and more flexible workflows.

These plans are tailored to the business’s specific needs but are often more expensive due to the increased level of customization.

Key features of custom enterprise plans:

- Dedicated account manager

- Advanced payroll integration

- High-touch support for complex HR needs

Rippling’s pricing transparency is a double-edged sword. While businesses can tailor their plan to suit their exact needs, the modular system can quickly add up if you’re not prepared for the extra costs of global expansion.

What Rippling’s pricing structure really means for your team

Before making any decisions, it's crucial to calculate the total cost of ownership (TCO) for your global workforce. Don’t forget to factor in hidden costs like usage-based billing, which can fluctuate month-to-month depending on the number of employees or contractors in the system.

In the next section, we’ll take a closer look at two pricing examples to help you understand how Rippling’s costs translate into actionable numbers for your business.

Examples of how Rippling’s pricing works

Understanding Rippling’s pricing structure in theory is one thing—putting it into practice is another.

To give you a clearer picture of how much Rippling might actually cost your business, we’ve compiled some two examples for different team sizes and configurations. These scenarios should help you visualize how Rippling payroll pricing, EOR pricing, and additional add-ons can impact your budget.

Example 1: A 50-person team using HR, payroll, and EOR services

Let’s assume your company is growing internationally, and you’re using Rippling’s HR platform, payroll, and EOR services for employees based in multiple countries.

- Base plan: $8 per employee per month (covering HR and payroll processing for U.S.-based employees).

- EOR service: $1,000 per month per employee in countries where you don’t have a local entity (e.g., Germany, France, or the UK).

- Global payroll: For employees outside of the U.S., expect an additional $200 per employee per month to manage international payroll compliance.

Estimated monthly cost for 50 employees:

- Base HR and Payroll: 50 x $8 = $400

- EOR (for 10 international employees): 10 x $1,000 = $10,000

- Global payroll (for 10 international employees): 10 x $200 = $2,000

Total: $12,400 per month (just for HR, payroll, and EOR services)

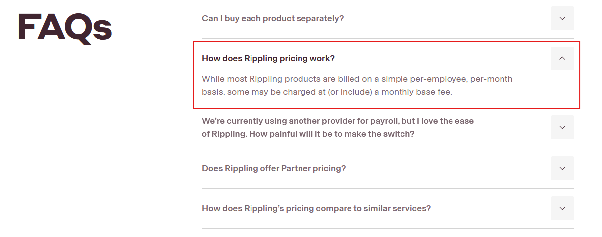

In addition to this, Rippling has confirmed in its website that some products which will be billed separately based on a monthly base fee, potentially adding hundreds or even thousands more depending on the complexity of your operations.

Caption: Rippling charges additional monthly base fees for some products, which could significantly increase your total cost.

Example 2: A smaller company (20 employees) expanding into Europe

For smaller companies with fewer international hires, the costs of Rippling’s payroll and EOR services may not seem as high, but they can still add up as your team scales.

- Base plan: $8 per employee per month.

- EOR service: $1,000 per month per employee in Europe.

- Global payroll: $200 per employee for managing payroll across borders.

Estimated monthly cost for 20 employees:

- Base HR and payroll: 20 x $8 = $160

- EOR (for 5 international employees in Europe): 5 x $1,000 = $5,000

- Global payroll (for 5 international employees): 5 x $200 = $1,000

Total: $6,160 per month (for HR, payroll, and EOR services)

Again, these estimates don’t include potential add-ons for benefits management, compliance, or contract generation, which could further drive up costs as your team grows.

These examples clearly demonstrate that Rippling’s pricing structure can become quite complex as you scale your team globally. For mid-sized companies, especially those managing a mix of U.S. and international employees, the costs can quickly escalate, particularly if you need EOR services or global payroll management.

Common pain points: hidden fees, usage-based billing confusion in Rippling’s pricing

While Rippling offers flexibility with its modular pricing, this approach can introduce significant challenges, particularly when it comes to hidden fees and usage-based billing.

As businesses scale globally, the complexities of these pricing structures can quickly become overwhelming, leading to unexpected costs that can strain budgets and disrupt financial forecasting.

1. Hidden fees and scalable costs

One of the most common pain points businesses face when using Rippling is the hidden fees associated with various add-ons and services. While Rippling’s base pricing may seem reasonable for small or domestic teams, the costs for global expansion can quickly escalate, especially if you need to scale up services across multiple countries.

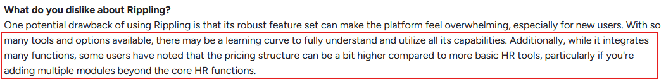

Rippling pricing user reviews

For example, if you expand into new international markets, Rippling may charge extra for:

- Visa and immigration support: Not always included in the base pricing and can add several hundred dollars per employee for visa processing.

- Custom benefits administration: If you offer region-specific benefits (e.g., health insurance or retirement contributions), these can lead to additional costs, which are often not fully disclosed until you’re deep into the setup process.

These charges are often not included in the base pricing, so it’s crucial for businesses to understand exactly what they’re getting and whether the features they require are covered under the plan they’ve chosen. This can lead to a higher-than-expected total cost of ownership.

2. Usage-based billing: the more you scale, the higher the costs

Another significant challenge with Rippling’s pricing is the usage-based billing model. While this may sound attractive at first, it can quickly lead to budgeting headaches for companies with growing teams.

-

Employee count: As your workforce grows, you’ll pay more each month for employees—both in your home country and internationally. These costs may increase month-to-month depending on the number of employees added, leading to unpredictable expenses.

Further, there have also been user statements about Rippling locking in customers in rigid plans that they no longer require.

Caption: Rippling’s pricing user review on Reddit

Caption: Rippling’s pricing user review on Reddit

- Contractor management: Even if you’re only hiring a small number of contractors, managing them through Rippling’s contractor of record (COR) service may come with additional fees that can accumulate as your team expands.

- Tiered services: Rippling’s pricing for some features (such as EOR services) may be tied to tiers that increase with the number of employees or regions, meaning the more countries you expand into, the more you’ll pay per service.

The scalable costs make it difficult to predict long-term pricing, which can be a burden for CFOs and HR managers tasked with maintaining budget certainty.

3. Confusing pricing structures across regions

For businesses with international operations, another challenge is the regional variation in pricing. While Rippling provides a global service, the pricing for each country or region may vary based on local laws, taxes, and payroll regulations. For example:

-

EOR services in countries with complex labor laws, like Germany or Japan, can be significantly more expensive than in regions with simpler regulations.

-

Payroll processing in certain regions may incur additional costs for compliance and tax filings that are not immediately apparent.

These differences often require detailed understanding and management, which can be hard to track without the right resources or planning.

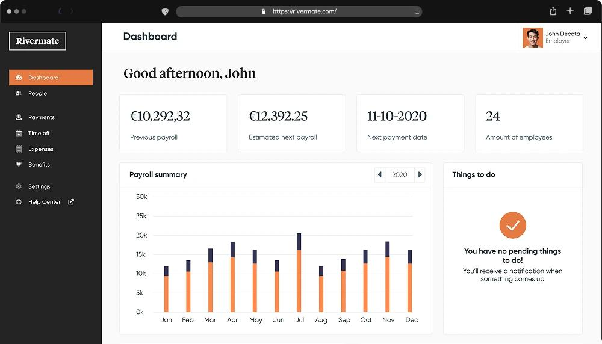

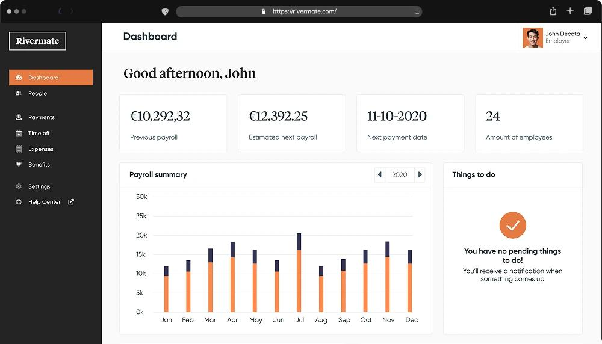

How Rivermate differs: transparency and predictability

This is where Rivermate offers a clear advantage. Unlike Rippling, which relies on complex modular pricing and can present challenges with hidden fees, Rivermate’s pricing is transparent and predictable.

Caption: Rivermate’s dashboard

We offer the following:

-

All-inclusive pricing for EOR services, global payroll, and visa support, with no hidden fees.

-

Scalable solutions that grow with your business, without unexpected increases in pricing as your team expands internationally.

-

Clear, predictable pricing that allows you to plan accurately for global hiring, helping avoid any surprise costs along the way.

Why Rivermate is a compelling alternative

When evaluating global workforce management solutions, pricing is only one aspect to consider. The true value lies in how well the platform meets your unique business needs—and Rivermate offers compelling reasons to consider it as an alternative to Rippling.

While Rippling excels in flexibility, it’s not always the best choice for businesses looking for clarity, high-touch support, and a seamless, all-inclusive global employment solution.

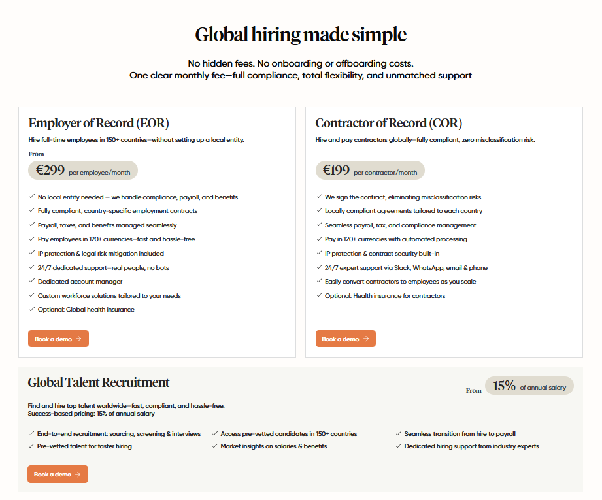

1. Predictable, transparent pricing

Rippling’s modular pricing and hidden costs can be a challenge for businesses looking for budget certainty.

In contrast, Rivermate offers all-inclusive pricing that covers payroll, compliance, benefits, EOR services, and more—all in one package. This eliminates the need for businesses to worry about unexpected costs related to add-ons or regional price variations.

Caption: Rivermate’s pricing plans

With Rivermate, businesses know exactly what to expect and can plan their budgets effectively, with no surprises down the line. Whether you're hiring employees in one country or expanding globally, Rivermate’s pricing stays transparent and predictable.

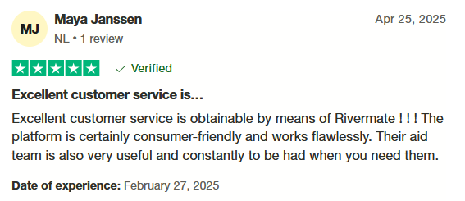

2. Human-first support, not automated systems

Rippling’s automation-heavy approach can be a barrier for companies that need personalized support, especially when handling complex international compliance or HR issues. While Rippling’s chatbots and self-service tools might work for some, they fall short when businesses need quick, human-driven resolutions to urgent issues.

In contrast, compared to Deel and other EOR service providers, Rivermate puts people at the center of the service, offering dedicated Global Account Managers and a high-touch, relationship-driven support model. That way, your request doesn’t end up adding to a long queue of pending customer requests but is promptly addressed.

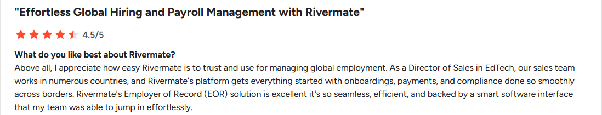

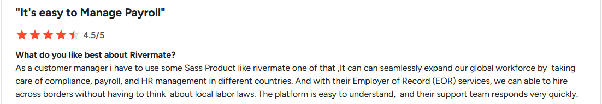

Caption: User review about Rivermate’s customer service

Caption: User review about Rivermate’s customer service

Whether it’s legal guidance, tax compliance, or payroll processing, Rivermate’s team is available 24/7 on Slack, WhatsApp, or email, providing direct access to experts who understand your business and its unique needs. This level of responsiveness ensures that you never have to rely on impersonal ticketing systems or automated solutions.

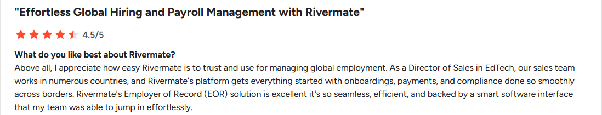

3. Seamless global expansion with EOR services

As companies expand into new markets, the need for EOR services becomes crucial. While Rippling provides EOR services, its pricing for international hiring can be unpredictable, depending on the country and the complexity of local labor laws.

The process of onboarding and maintaining employees can also be cumbersome, with additional steps for managing compliance and benefits across different regions.

Caption: User review of Rivermate about its global EOR services

Caption: User review of Rivermate about its global EOR services

Rivermate’s EOR services are designed with global expansion in mind, offering a streamlined process for managing international hires without the need to set up entities.

With Rivermate, you gain the following:

-

Comprehensive global coverage in 150+ countries, with all-in-one pricing for compliance, benefits, taxes, and payroll.

-

Simplified onboarding and contract management, so you can hire employees across borders in just days—not months.

-

Ongoing compliance support, ensuring that as laws and regulations evolve, your business stays ahead of changes with proactive legal updates and contract refreshes.

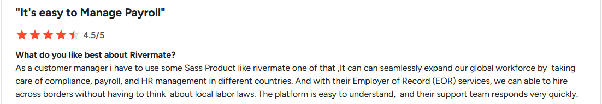

4. Flexibility and customization for mid-market companies

For mid-sized businesses, the ability to customize workflows and adapt the platform to specific needs is critical. Rippling’s automated workflows can be too rigid for companies with more complex requirements, especially when dealing with unique legal cases or specialized benefits packages.

Rivermate adapts to your workflows—whether that means custom approval layers, tailored benefits, or specific contract terms. It is built for flexibility, so your team doesn’t have to work around rigid systems. This flexibility is especially beneficial for companies scaling into new markets, where each country might have different compliance requirements.

5. A true partnership for global expansion

Unlike Rippling, which positions itself as a software platform, Rivermate focuses on being a true global employment partner.

From initial strategy consultation to day-to-day HR and payroll support, Rivermate’s team is embedded with yours, providing the legal, financial, and operational expertise needed for successful global expansion. Additionally, Rivermate’s in-country legal teams monitor legislation daily, automatically update contracts, and issue alerts—all backed by SLAs and indemnification to ensure continuous compliance.

Caption: User review on Rivermate’s payroll management services

Caption: User review on Rivermate’s payroll management services

Alt text: Rivermate local compliance

Rivermate's commitment to partnership means that your HR, finance, and legal teams have direct access to the experts who are actively working on your behalf, ensuring a smooth and compliant hiring process across borders.

6. Predictable, transparent pricing

Rippling uses a modular pricing model—charging a base fee plus add-ons for global payroll, EOR services, and compliance tools. This setup may seem flexible at first, but it often results in unpredictable costs due to usage-based billing and regional price variations. As your team grows or expands into new markets, budgeting becomes more complex, with shifting fees tied to geography and employee count.

Rivermate offers a simpler, more predictable path. Its transparent, all-inclusive pricing covers everything—EOR services, payroll, benefits, visa support, and compliance—in one fixed cost per employee. There are no hidden fees or surprise add-ons, regardless of which countries you’re hiring in. That clarity gives HR, finance, and legal teams the confidence to plan ahead, forecast accurately, and scale without second-guessing what’s included.

Decision matrix: when to choose Rippling vs. Rivermate

Choosing the right global employment solution for your company depends on various factors including cost, support needs, and expansion goals. While Rippling and Rivermate both offer solutions for hiring and managing global teams, their approaches, pricing models, and levels of support differ significantly.

To help you make an informed decision, we’ve created this decision matrix based on key factors that matter most to mid-market companies expanding internationally.

1. Global reach & local expertise

| Factor |

Rippling |

Rivermate |

| Global coverage |

Supports 50+ countries for payroll, but requires local entities for some regions. |

Supports 150+ countries, including full EOR coverage without local entities. |

| Local expertise |

Limited local expertise. Relies on partners for global payroll. |

In-country legal, tax, and payroll experts in 150+ countries. |

2. Support and customer experience

| Factor |

Rippling |

Rivermate |

| Customer support |

Automated support model with limited personalization. Limited direct support. |

Dedicated Global Account Manager with 24/7 human support via Slack, WhatsApp, or email. |

| Account management |

Limited, self-service model with general support. |

Personalized, high-touch support from experienced HR, legal, and payroll experts. |

3. Customization & flexibility

| Factor |

Rippling |

Rivermate |

| Customization |

Limited customization options with rigid workflows. |

Highly flexible platform that adapts to your specific needs, from contract terms to workflows. |

| Global expansion support |

Standard solutions for most markets; May require additional customization for complex needs. |

Tailored solutions for expanding globally with flexible workflows and custom contracts. |

4. Compliance & legal support

| Factor |

Rippling |

Rivermate |

| Compliance support |

Limited in-country legal support. Dependent on external partners for compliance. |

Local legal expertise in 150+ countries to ensure full compliance with global employment laws. |

| Regulatory updates |

Not proactive in providing real-time updates or legal alerts. |

Proactive legal updates to keep you ahead of compliance changes in each country. |

Final recommendation

Rippling and Rivermate serve different needs. Rippling suits companies looking for a modular, automation-first platform with a self-service model. It is best for teams with limited global hiring and a tolerance for region-based pricing complexity.

Rivermate, on the other hand, is designed for mid-sized companies (500–5,000 employees) that are expanding globally by hiring 10–15 employees in each new market. With transparent, all-in pricing, expert-led legal support, and dedicated account management, Rivermate delivers a high-touch partnership that simplifies global hiring. If you value compliance certainty, predictable costs, and a human-first approach, Rivermate is the stronger choice.

Ready to expand globally without the headaches?

Book a free 30-minute consultation with Rivermate today!

FAQs

1. What is Rippling’s pricing model?

Rippling operates on a modular pricing system with a base plan and additional costs for add-ons like global payroll, EOR services, and benefits management. The cost varies based on the number of employees and the countries where you operate.

2. How does Rivermate compare to Rippling?

Rivermate offers a more transparent pricing model, covering EOR, global payroll, and compliance under one package, while Rippling uses modular pricing that can lead to hidden fees and unpredictable costs.

3. Can I scale my business with Rippling?

Yes, Rippling provides tools for scaling your business internationally. However, the modular pricing and potential hidden fees can complicate the budgeting process. Rivermate offers a more predictable and flexible solution for businesses looking to scale quickly without surprise costs.

4. Does Rivermate provide support for legal and compliance issues?

Yes, Rivermate offers dedicated legal and compliance support in 150+ countries. Our in-country experts provide proactive updates on regulatory changes, ensuring you remain compliant as you expand globally.

Rippling pricing user review

Rippling pricing user review

Caption: Rippling’s pricing

Caption: Rippling’s pricing

Caption:

Caption:  Caption:

Caption:  Caption:

Caption: