TL;DR

-

Global payroll services manage payments, taxes, and compliance across countries

-

Key benefits: Simplified payroll, reduced compliance risks, streamlined benefits, and scalability without setting up entities

-

Key components: Tax filings, multi-currency payroll, legal compliance, benefits, and contract generation

-

When choosing a provider: Consider local expertise, cost transparency, customization, and human support

-

Rivermate: Ideal for mid-sized companies (500–5,000 employees) hiring 10–15 employees per market, offering hands-on legal guidance and fast onboarding in 150+ countries

-

Top providers: Rivermate, Deel, Oyster, Papaya Global, Rippling, Multiplier, ADP, Globalization Partners, Skuad, Tarmack

10 Best Global Payroll Services of 2026

Managing payroll for a growing workforce across multiple countries can be overwhelming. From fluctuating exchange rates to varying tax codes and local labor laws, the complexities of global payroll are many. But scaling internationally doesn’t have to be daunting, provided you have the right partner by your side.

A trusted global payroll service provider can simplify these challenges. Whether you’re expanding into new markets, hiring remote teams, or managing employees across borders, the right solution ensures your team is paid accurately and in full compliance with local laws. With so many options available, finding the right fit can feel overwhelming.

In this guide, we’ll compare the 10 best global payroll software in 2026, offering insights into the challenges businesses face and the key factors to consider when selecting the right provider for your global expansion. By the end, you’ll be equipped with the knowledge to make the best choice for your growing business.

| Disclaimer: Links to third-party government sites are provided for convenience and informational purposes only. We do not endorse or guarantee the accuracy of information on external websites. |

Why businesses need a global payroll provider

Hiring talent abroad unlocks access to new markets, time zones, and skill sets, but it also brings complexity. Local tax codes, currency conversion, benefits compliance, and employment laws vary widely from country to country.

Recent changes to minimum salary requirements for work permits and visas—like those for the EU Blue Card and Skilled Worker Permits—further complicate the landscape. Without expert guidance, a single misstep can trigger fines, payroll delays, or reputational damage.

Aon's 2026 Global Pay Transparency Study additionally reveals that while 71% of organizations have improved their pay transparency readiness over the past year, only 19% feel fully prepared to embrace the changing landscape. Without expert payroll solutions, businesses risk missing key updates, resulting in payroll delays, compliance violations, and even reputational damage.

Global payroll providers offer more than just processing; they centralize payroll, tax, and benefits management, ensuring compliance and accuracy. By strategically aligning with pay transparency regulations, businesses can also foster employee trust, improve retention, and ensure consistent engagement across regions.

Choosing the right payroll provider ensures that your company’s global expansion remains compliant, efficient, and scalable, helping you stay ahead of regulatory changes while minimizing risk.

Types of global payroll providers

| Type |

Description |

Ideal For |

Example |

| Traditional payroll firms |

Local vendors who manage country-specific payroll, filings, and compliance, often working directly with local tax authorities |

Companies with in-country legal entities |

ADP - Best for large companies with established subsidiaries or those with a complex local presence that need highly specialized services for payroll |

| Global payroll SaaS platforms |

SaaS tools that unify payroll processing and reporting, often relying on third-party partners for local expertise while centralizing management |

Enterprises managing payroll for established subsidiaries |

ADP and Rippling - Suitable for enterprises seeking automation and centralized payroll management, offering tools that simplify cross-border payroll tasks |

| Employer of Record (EOR) |

The payroll service becomes the legal employer on your behalf, handling contracts, onboarding, payroll, tax, and compliance, without needing a local entity |

Companies hiring full-time employees without setting up local entities |

Rivermate, Deel - Ideal for companies expanding into new markets quickly, allowing them to hire globally without creating new legal entities |

Caption: Comparison of types of global payroll providers

What to look for in a global payroll solution

Before you compare providers, make sure your shortlist covers these essential areas:

-

Compliance with local employment law: Are contracts drafted with local legal experts? Does the provider stay ahead of regulatory updates?

-

Multi-currency support: Can they handle payroll in 120+ currencies with proper exchange rate protections?

-

Scalability: Do they support fast onboarding in multiple countries without requiring new entities?

-

Transparent pricing: Is the cost structure clear? Are there any surprise fees (e.g., implementation charges, contract amendments)? Rivermate, for example, offers fixed pricing per employee per month, ensuring you know exactly what you’ll pay each month, with no hidden fees for basic services.

-

Human support: Are real experts available 24/7 via Slack, WhatsApp, or phone, with no bots or ticket queues?

-

Problem-solving, not just processing: Can the provider handle custom contract clauses or urgent compliance fixes with speed and care?

-

Proactive workforce guidance: Does the provider proactively anticipate challenges and offer guidance before issues arise?

-

Beyond EOR: full HR & payroll support: Can the provider handle custom benefits, local HR guidance, or unusual employment setups with ease?

-

Security and reliability: Does your global payroll service provider protect sensitive employee data, such as salary details and tax deductions, through measures like encryption, multi-factor authentication, regular backups, firewalls, and audit trails?

Now that you know what to look for in the best global payroll software, let’s take a closer look at some of the top global payroll providers in 2026.

Top 10 global payroll providers in 2026

Here’s a deep dive into the most trusted global payroll service providers, their specializations, and who they’re best suited for:

| Provider |

Strengths |

Ideal Use Case |

Pricing |

| Rivermate |

Dedicated legal guidance, all-inclusive pricing, fast onboarding in 150+ countries |

Mid-sized companies hiring 10–15 people per new market |

EOR services: From €299 per employee per month Contractor of Record services: From €199 per employee per month |

| Oyster |

Great UI, equitable pay benchmarking, localized benefits packages, payroll and hiring in 180+ countries |

Remote-first teams focused on employee experience |

Global payroll starts at $29 per employee/month EOR services start at $699 per employee per month |

| Papaya Global |

Strong integrations, analytics, and API-driven payroll management, payroll in 160+ countries |

Enterprises needing hybrid payroll and vendor aggregation |

Custom pricing based on company size, regions, and employee count. |

| Rippling |

Unified HR + IT suite, good for companies expanding globally; hiring and payroll in 185+ countries |

Enterprises needing a suite of HCM, EOR, Contractor of Record, payroll solutions |

Custom pricing |

| Multiplier |

Quick deployments, competitive rates, strong Asia presence, global coverage across 150+ countries |

Remote and globally distributed workforces |

For global payroll, contact the sales team. EOR services, starting at $400 per month per employee |

| Deel |

Broadest feature set, fintech services, payroll services in 130+ countries |

Scale-ups looking for an all-in-one automation-driven platform. However, it caters to startups, mid-market firms, and even enterprises. |

Global payroll: $29 per employee per month |

| ADP |

Legacy payroll expertise, strong enterprise footprint; hiring and payroll in 140+ countries |

Multinational companies with deep internal HR processes. However, it also caters to small and mid-sized businesses. |

Custom pricing based on company size, payroll needs, and location. |

| Globalization Partners |

Entity-based EOR with strong legal reputation, global coverage across 180+ countries |

Risk-averse companies expanding into high-compliance markets; fast global expansion without local entities |

Custom pricing based on regions and employee count. Contact for detailed quote. |

| Skuad |

Developer-friendly onboarding, remote-first focus, hiring and payroll in 160+ countries |

Fast-growing, remote-friendly organizations, particularly tech startups, SaaS scale-ups, and mid-market firms |

Custom quote for enterprises; EOR services: Starting at $199 per employee per month |

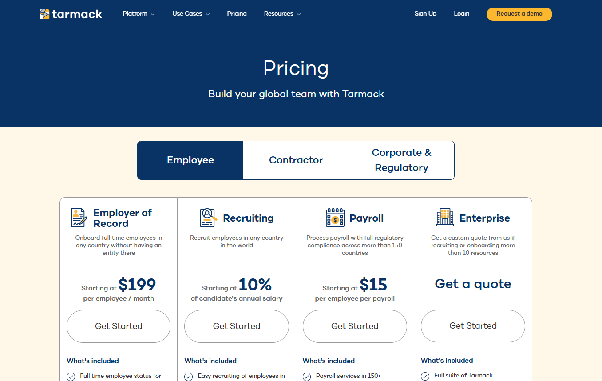

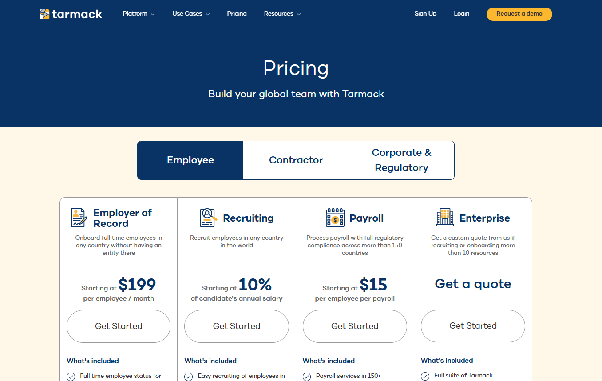

| Tarmack |

Lightweight solution for quick entry into new markets; hiring in 150+ countries |

Firms needing low-cost global onboarding support |

Global payroll services starting at $15 per employee per payroll. EOR services starting at $199 per employee per month |

Caption: Comparison of the top 10 global payroll providers

1. Rivermate

Caption: Screenshot of Rivermate’s payroll processing software interface

Rivermate offers comprehensive global payroll solutions in 150+ countries, automating your employees’ salary payments, tax withholdings, and compliance with local labor laws.

We centralize your payroll and benefits administration, ensuring accuracy and regulatory adherence. With real-time reporting and dedicated account managers, Rivermate provides personalized support, helping you streamline international payroll, minimize risks, and scale with confidence.

This integrated approach simplifies your global workforce management, making complex processes more efficient and easier to handle within one unified solution.

Rivermate key features

- EOR: Hire employees in 150+ countries without setting up legal entities

- Compliance & legal support: Proactive compliance management with local legal experts

- Local payroll processing: Multi-currency payroll and statutory benefits

- Real-time cost simulations: Helps you calculate costs before hiring employees

- Dedicated account manager: Human support via Slack, WhatsApp, or email

- Visa & immigration support: Work permit management through local partners

- Seamless onboarding: Quick setup and auto-generated contracts

- Complex and custom hiring needs: We’re here to support even your most complex hiring needs whether it’s expanding into emerging markets or navigating highly regulated industries.

Rivermate pros and cons

| Pros |

Cons |

| Local legal and payroll compliance across 150+ countries |

May not be the best fit for very large enterprises with complex payroll needs |

| Dedicated account manager |

Not suitable for short-term gig or crowd platforms |

| Transparent pricing model (no hidden fees) |

Organizations with fewer than ~25 total employees may not be able to utilize Rivermate’s full range of capabilities |

| Rapid global onboarding in 48 hours |

|

| Hire globally in days. No entity setup needed. |

|

| Human support via Slack, WhatsApp, or email |

|

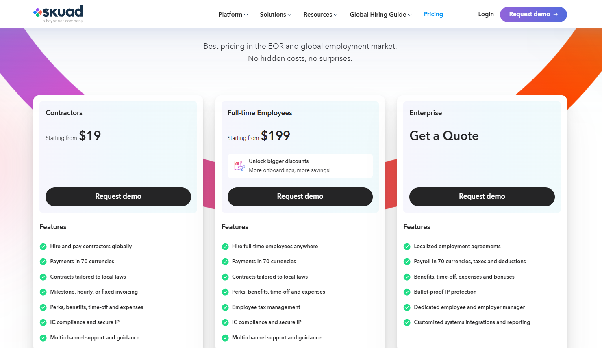

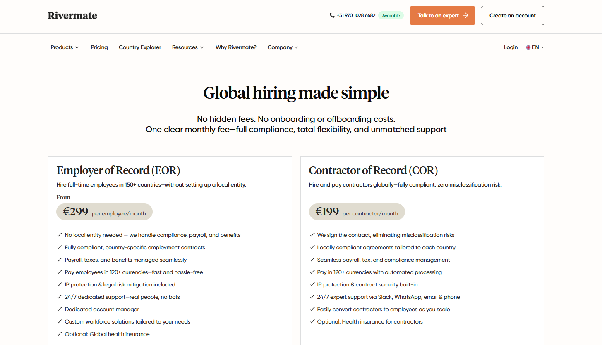

Rivermate pricing

Rivermate’s pricing page

Rivermate’s pricing page

Source

2. Oyster

Caption: Oyster HR’s payroll processing software interface

Oyster is a remote-first global payroll platform designed to simplify international hiring. With EOR services, Oyster provides compliant contracts, benefits, payroll, and legal support in multiple countries, making it an ideal solution for companies with distributed teams.

Oyster key features

-

Remote workforce management: Ideal for managing remote-first teams across the globe

-

Self-service platform: Allows HR teams to handle payroll, contracts, and compliance directly

-

Salary benchmarking: Provides region-specific salary insights

Oyster pros and cons

| Pros |

Cons |

| Easy to use (source) |

Notification system could do with improvements (source) |

| Intuitive platform (source) |

Limited real-time visibility into claim status (source) |

| Great customer support (source) |

Responses from the payroll team may take longer than anticipated (source) |

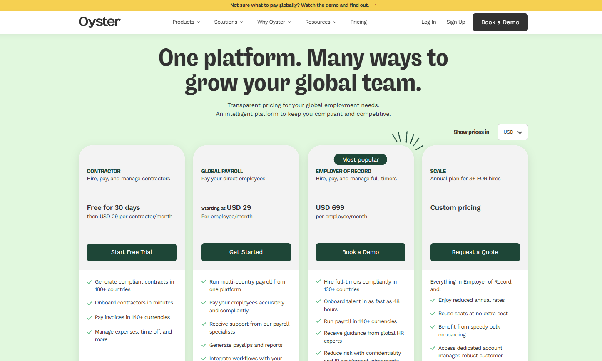

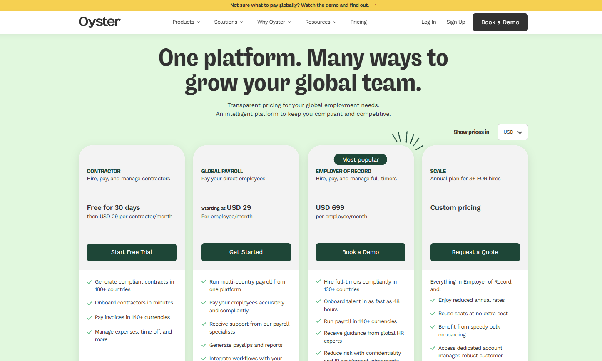

Oyster pricing

Caption: Oyster HR’s pricing page

3. Papaya Global

Caption: Papaya Global’s payroll processing software page

Papaya Global is a global payroll and workforce management platform offering cloud-based payroll processing, seamless HRIS integrations, and EOR services. The platform automates payroll operations, ensures compliance with local regulations in 160+ countries, and delivers advanced analytics for actionable global workforce insights.

Papaya Global key features

- Payroll automation: Automated global payroll processing in 160+ countries

- Advanced analytics: Provides data-driven insights for payroll and financial planning

- Flexible payroll models: Manages both employee and contractor payroll

Papaya Global pros and cons

| Pros |

Cons |

| Payroll processing is quick and efficient (source) |

Pricing can be complex for mid-market companies (source) |

| User-friendly platform (source) |

Slight learning curve (source) |

| Exceptional customer support (source) |

|

Papaya Global pricing

Custom pricing based on company size, regions, and employee count. Contact for detailed quote.

4. Rippling

Caption: Rippling’s payroll processing software page

Rippling is a comprehensive HRIS + global payroll platform designed to handle everything from payroll to IT management. Its global payroll solution is deeply integrated with HR, IT, and benefits management, making it ideal for companies already using Rippling’s platform for other HR tasks.

Rippling key features

- Unified HRIS + payroll: Combines HR, IT, and payroll into a single platform

- Automated payroll: Fully automated payroll processing for global teams

- Bulk payments: Bulk pay runs for global teams, including both employees and contractors, managed from a centralized dashboard

Rippling pros and cons

| Pros |

Cons |

| Easy to implement (source) |

With constant updates, users mention it’s hard to keep up with new features (source) |

| Easy-to-use interface (source) |

Limited features outside the HR/IT scope (no specialized legal support) (source) |

| Team is extremely responsive and knowledgeable (source) |

Delayed vendor payments (source) |

|

Limited customer support during implementation (source) |

Rippling pricing

Custom pricing

5. Multiplier

Caption: Multiplier’s global payroll software

Multiplier is an EOR and global payroll platform designed to help startups and SMEs hire employees globally without the need for local entities. It provides payroll, benefits, taxes, and compliance in 100+ countries with a focus on quick deployment and ease of use.

Multiplier key features

- Multi-currency payroll: Runs payroll and enables payments in 120+ currencies, ensuring seamless, on-time compensation for global employees and contractors

- Tax and compliance: Handles tax filings, statutory deductions, and benefits administration in full compliance with country-specific employment laws

- Real-time cost estimates: Instantly calculates total employment costs—including salary, benefits, and statutory charges—for any country before hiring

Multiplier pros and cons

| Pros |

Cons |

| Faster chat support and a dedicated account manager (source) |

Frequent changes in customer managers and unclear handovers, requiring extra meetings to review past cooperation (source) |

| Cost-effective global hiring (source) |

Slow internal communication and lack of clarity on payslips (e.g., unused leave days, training hours) (source) |

| User-friendly interface (source) |

Website can be buggy (source) |

| Quickest payment settlement times (source) |

|

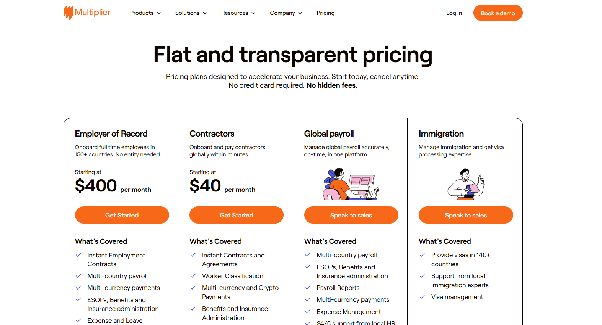

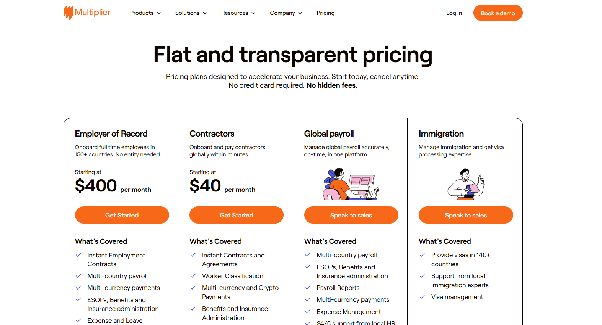

Multiplier pricing

Caption: Multiplier’s pricing page

6. Deel

Caption: Deel’s global payroll service software

Deel is an all-in-one global HR platform that started with contractor management but has since expanded into EOR and full payroll services. It supports compliance in 130+ countries with quick onboarding and automated solutions for both contractors and employees.

Deel key features

- Global payroll: Manages payroll for employees and contractors in 130+ countries

- Deel AI included for instant compliance and HR answers

- 2,000+ in-house experts in payroll, HR, and legal

Deel pros and cons

| Pros |

Cons |

| Smooth money transfers to bank accounts (source) |

Lacks personalized support for complex legal and HR cases |

| Quick setup with automated workflows (source) |

More rigid workflows for companies with unique needs |

| Great customer support (source) |

|

| User-friendly platform (source) |

|

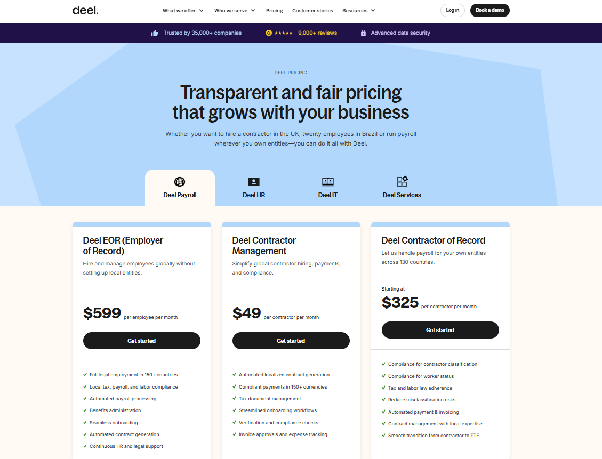

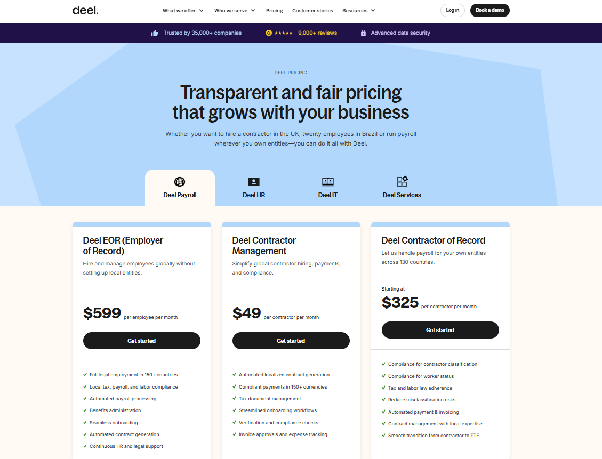

Deel pricing

Caption: Deel’s pricing page

7. ADP

Caption: ADP’s global payroll service software

ADP is a well-established provider of payroll services with a deep focus on compliance, offering solutions for large enterprises and multinational corporations. ADP handles payroll processing, tax filing, employee benefits, and compliance across multiple countries, leveraging its decades of experience to manage complex payroll needs.

ADP key features

- Automated global payroll processing: ADP’s cloud platform automates payroll in 140+ countries, ensuring accurate, on-time salary payments in multiple currencies while managing tax deductions and compliance with local regulations.

- Compliance and tax management: ADP handles tax calculations, deductions, and filings at all levels, with regular updates to ensure compliance and avoid penalties.

- Integrated analytics and reporting: The platform provides real-time payroll insights and analytics, helping businesses track costs, workforce trends, and compliance status for better decision-making.

ADP pros and cons

| Pros |

Cons |

| Extensive compliance and payroll expertise (source) |

Some features can feel clunky (source) |

| Customizable reporting tools (source) |

It can feel overwhelming for some users (source) |

|

Not user-friendly (source) |

ADP pricing

Custom pricing and packages based on company size, payroll needs, and location.

8. Globalization Partners

Caption: Globalization Partners’ global payroll software

Globalization Partners simplifies global payroll by handling payments, tax filings, and compliance in 180+ countries. Their platform ensures businesses can scale internationally while staying compliant with local payroll regulations, without needing local entities.

Globalization Partners key features

-

Payroll solutions: Handles global payroll processing for employees and contractors in 180+ countries, providing timely, compliant salary payments in local currencies and robust automated reporting

-

Compliance expertise: Offers deep, proactive expertise in local tax, labor, and benefits regulations, supported by in-region HR/legal specialists and industry-leading compliance automation tools to minimize international hiring risks

-

Global workforce management platform: Enables hiring, onboarding, and managing of global teams through a centralized, technology-driven platform that integrates with leading HR systems. Ideal for companies scaling or operating across multiple countries with complex needs.

Globalization Partners pros and cons

| Pros |

Cons |

| Customer Success Manager service (source) |

Lack of phone support (source) |

|

AI chatbot struggles to address users’ specific questions or provide helpful guidance. (source) |

|

Users report payroll mistakes (source) |

Globalization Partners pricing

Custom pricing based on regions and employee count. Contact for detailed quote.

9. Tarmack

Caption: Tarmack’s global payroll software

Tarmack offers a simple and cost-effective solution for global payroll management and EOR services. With the ability to hire employees in various countries without setting up local entities, Tarmack helps businesses expand into new markets quickly and compliantly. The platform supports multi-country payroll, compliance, and tax management, all while providing a straightforward user experience for businesses looking for an affordable global hiring solution.

Tarmack key features

- Payroll processing: Streamlined payroll processing across different countries

- Custom contracts: Generates contracts specific to each country’s legal requirements

- Quick onboarding: Allows businesses to onboard employees rapidly across new markets

Tarmack pros & cons

| Pros |

Cons |

| Developer-friendly tools for easy cross-border contracting (source) |

Less proven brand compared to competitors (source) |

| Simple, low-effort onboarding designed for small teams (source) |

Less proactive with local nuances or emerging regulatory changes (source) |

|

Limited integrations (source) |

Tarmack pricing

Caption: Tarmack’s pricing page

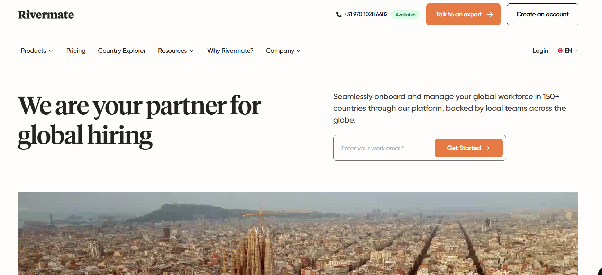

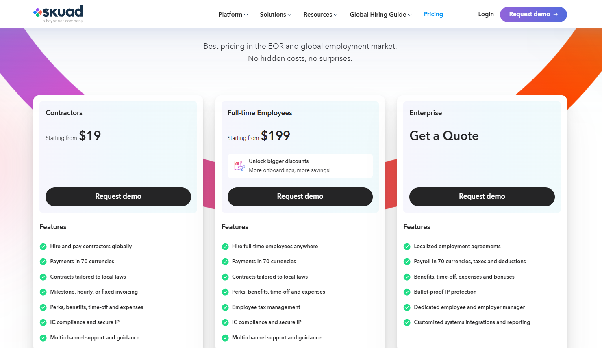

10. Skuad

Caption: Skuad’s global payroll processing software

Skuad is a global EOR platform that simplifies the process of hiring and managing employees and contractors in over 160 countries. It offers full payroll management, compliance, and employee benefits administration. Skuad allows businesses to focus on scaling while it takes care of the local complexities involved in global hiring. The platform supports both full-time employees and contractors, ensuring proper classification and compliance with local labour laws.

Skuad key features

- EOR and contractor management: Helps businesses hire employees and contractors globally

- Multi-country payroll: Automates payroll processing for distributed teams, supporting payments in over 100 currencies and ensuring accurate, on-time salary disbursement globally

- Local compliance: Handles complex local tax, benefits, and employment law compliance for every jurisdiction, reducing legal risk for international hiring

Skuad pros & cons

| Pros |

Cons |

| Reliability of their payroll system (source) |

Travel expense reporting module could be more intuitive (source) |

| Portal is intuitive (source) |

Employee benefit plans could do with improvement (source) |

| Responsive customer support team (source) |

Payroll processing times are not that fast (source) |

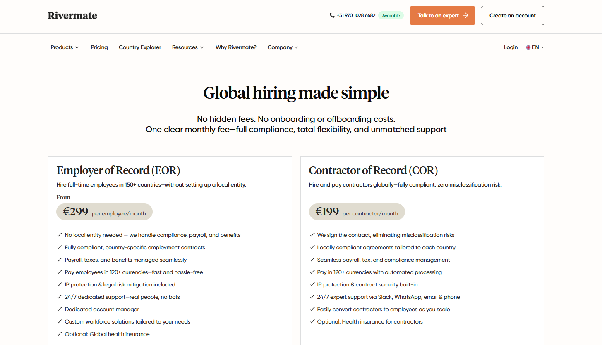

Skuad pricing

Caption: Skuad’s pricing page

Take the next step in global expansion with Rivermate

Choosing the right global payroll provider is critical for businesses looking to expand internationally. With a wide range of options available—each offering unique features such as compliance management, multi-country payroll processing, and customized employee benefits—it’s important to select a provider that truly fits your company’s needs and growth goals.

Rivermate stands out for mid-sized companies looking to scale quickly and compliantly across 150+ countries, without the complexity and cost of setting up local entities.

With transparent pricing, personalized support, and an easy-to-use platform, Rivermate simplifies global payroll, helping you stay compliant while focusing on what matters most—your business growth.

Whether you're managing a global workforce, expanding into new markets, or planning to hire employees internationally, the right global payroll solution can streamline operations, minimize risks, and give you the confidence to scale your business smoothly.

Ready to simplify your global payroll process? Book a 30-minute consultation with Rivermate today and begin expanding globally with confidence and ease.

FAQs

1. What is the best global payroll provider?

The best global payroll provider depends on your company’s needs. Key factors to consider include compliance expertise, pricing transparency, multi-country support, and customer service. Rivermate, Deel, and Oyster are top contenders based on these criteria.

2. What is global payroll?

Global payroll refers to the process of managing and processing employee compensation, taxes, benefits, and compliance across multiple countries. It ensures employees are paid accurately and on time while adhering to local regulations.

3. What are the benefits of using global payroll services?

Global payroll services simplify international hiring, ensure compliance with local laws, streamline payroll processing, and reduce administrative burdens. They provide companies with the flexibility to scale operations globally without setting up legal entities in each country.

4. What are the key components of global payroll?

Key components include tax filings, statutory benefits management, multi-currency payroll, legal compliance, and contract generation. A strong global payroll system integrates these elements to provide timely, accurate, and compliant employee payments.

Rivermate’s pricing page

Rivermate’s pricing page