International Recruitment

How Can a U.S. Company Hire a Foreign Employee

Discover the best ways for U.S. companies to hire foreign employees legally, including visa sponsorship, contractors, or using an Employer of Record.

Lucas Botzen

Global Employment Guides

13 mins read

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demoTL;DR

ADP Pricing Overview: ADP offers a flat-rate pricing model but hides additional fees for services like global payroll, contractor management, and compliance. Pricing varies based on business size, location, and chosen service package.

ADP Pricing Summary:

Base pricing: Starts at ~ $79/month + $4 per employee for U.S. payroll; custom quotes apply for additional services.

Global payroll: Available as an add-on—pricing varies by country and complexity.

Hidden/additional fees: Common charges include:

~$2,000 one-time implementation fee (based on user reports)

Contractor fees

Compliance advisory and document updates

Weekly/bi-weekly payroll runs

Regional surcharges for complex tax/legal jurisdictions

Promotional offers: Up to 3 months of free payroll for new U.S. clients, but limited to RUN Powered by ADP users with under 50 employees.

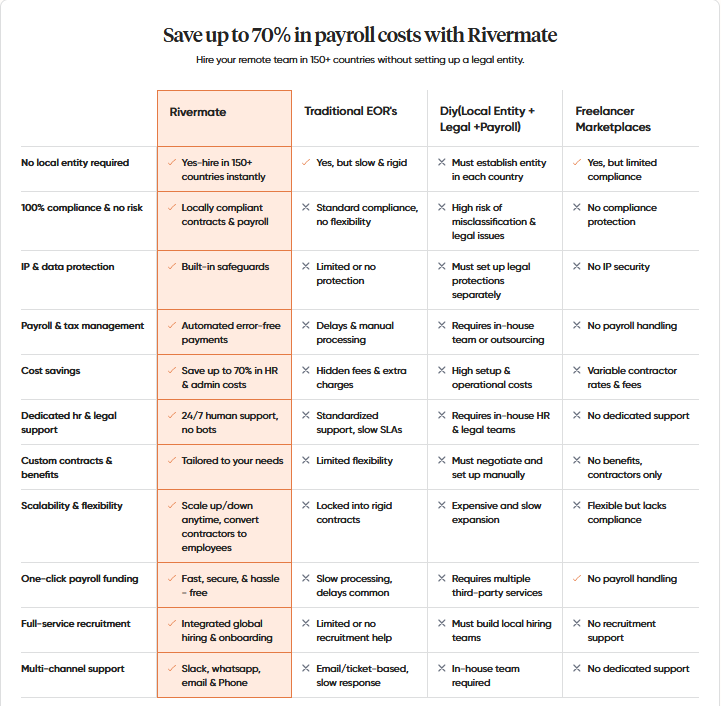

Rivermate's Pricing Advantage: Rivermate provides clear, transparent pricing without unexpected fees. It focuses on international scalability with a fixed-rate model, making it easier to forecast and manage payroll costs.

Key Differences: While ADP is a comprehensive solution, Rivermate offers flexibility, simpler global payroll management, and high-touch support without hidden costs. It's especially advantageous for businesses expanding internationally.

ADP is a payroll and employer of record (EOR) services provider, trusted by businesses of all sizes for its experience in payroll processing, tax compliance, and workforce management.

Among its key offerings, “Run Powered by ADP” is tailored for small and mid-sized businesses, providing a streamlined approach to managing payroll and HR tasks.

Caption: RUN Powered by ADP service page

While Run Powered by ADP’s feature set and brand recognition are undeniable, its pricing plays a crucial role when businesses evaluate payroll and EOR solutions. Understanding ADP ’s pricing structure is vital for making an informed decision.

ADP’s pricing model is designed to accommodate businesses of varying sizes and complexities. At its core, ADP offers a flat-rate EOR pricing structure, which is often appealing to companies looking for predictable costs. However, there are several factors that influence how much businesses will ultimately pay for ADP ’s services.

ADP does not publicly disclose the pricing for its Run Powered by ADP service, as costs are influenced by several factors. These factors include whether you are a new or existing customer, the location of your business, and the size of your workforce.

Caption: RUN Powered by ADP payroll packages for small businesses

However, based on information from various online sources and user reports, here’s a general overview of what you can expect:

ADP ’s pricing is determined by the following key factors:

While ADP ’s flat-rate pricing provides some clarity, there are several add-ons and hidden fees that businesses should be aware of to fully understand the total cost of their payroll and employer of record (EOR) services.

These additional charges can vary depending on the services required and the regions in which a company operates.

Let’s break down some of the most common add-ons and hidden fees associated with ADP :

Caption: WorkMarket by ADP for contractor management

ADP offers contractor management services, typically at additional costs. Fees may include setup, ongoing administration, and compliance with local tax laws, which can add up if you have a large contractor workforce

Caption: ADP Global Payroll module

Global payroll services come with additional charges that vary by country and depend on the number of countries and the complexity of local regulations. International payroll needs may incur higher administrative and compliance costs.

Caption: ADP benefits administration offering

Benefits administration is an optional add-on, with fees for setup, ongoing management, and compliance with local regulations. Costs vary depending on the package chosen, and it’s important to understand what’s included in your base service.

Caption: ADP SmartCompliance module

ADP offers compliance services, but these often come with additional fees, especially for businesses operating in multiple regions. Costs can include legal guidance, updates on tax laws, and handling specific compliance tasks.

One-time setup fees may apply when configuring ADP services, including payroll system setup and employee onboarding. Larger businesses or those with complex needs may face higher setup charges.

ADP ’s pricing varies by location, with higher costs for regions with complex tax laws or labor regulations. Businesses operating internationally may face unexpected fees based on regional requirements.

Opting for more frequent payroll runs, such as weekly or bi-weekly, may incur extra fees due to increased administrative resources required.

ADP offers multiple plans, each with increasing levels of features:

| Highlights | Details |

|---|---|

| Base pricing | Starts at $79/month (+$4 per employee), with custom pricing for enhanced features |

| Cost factors | Scales with number of employees, locations, features, customization needs, and integrated HR services |

| Discounts | Available for annual billing, bundles, non-profits, and promotional offers |

| Alternatives | Gusto, OnPay, and QuickBooks offer lower pricing for simpler needs |

| ADP advantage | Unified platform offering full payroll, HR, benefits, and talent management |

Table caption: Top-level breakdown of ADP pricing, cost factors and alternatives.

Here is a look at its payroll plan:

| Payroll Plan | Pricing | Features |

|---|---|---|

| Select payroll | Custom pricing | Simplify payroll and HR with an all-in-one suite. |

| Plus payroll | Custom pricing | Everything included in our "Select" package and streamline benefits administration with time-saving technology. |

| Premium package | Custom pricing | Everything included in our "Plus" package and automated time-tracking with Time and Attendance. |

Table caption: Top-level breakdown of ADP’s payroll pricing.

When evaluating ADP ’s pricing, it’s important to consider both the advantages and disadvantages to determine whether the platform offers good value for your business, especially when compared to other payroll and (EOR) solutions.

Here, we’ll break down the pros and cons of ADP ’s pricing model, focusing on transparency, hidden costs, and ROI for businesses with more complex payroll needs.

| Pros of ADP ’s pricing | Cons of ADP ’s pricing |

|---|---|

| Scalable for growing businesses: ADP accommodates businesses of all sizes, with flexible pricing that grows with the company. | Hidden fees and add-ons: Additional charges for contractor management, global payroll, benefits, and compliance can quickly increase costs. |

| Comprehensive service offering: ADP provides an all-in-one platform covering payroll, HR, benefits, and talent management. | Custom pricing for advanced features: Some packages and services are priced on a custom basis, requiring businesses to request quotes, complicating comparisons. |

| Transparent base pricing: The base pricing is clear, starting at $79/month + $4 per employee, helping businesses budget effectively. | Higher costs for multi-country payroll: Global payroll services come with extra costs, which can be expensive for international companies. |

| Discounts and promotions: ADP offers discounts for annual billing, bundles, non-profits, and promotional deals. | Complexity for smaller businesses: Small businesses with simpler payroll needs may find ADP ’s full-service offerings overwhelming and unnecessary. |

| Trusted brand with industry recognition: ADP is a reputable provider with extensive experience in payroll and HR services. | Setup and implementation costs: One-time setup fees for configuring payroll systems can add to the initial cost. |

| Less transparency for custom quotes: Custom pricing for advanced services makes it difficult to estimate costs without contacting ADP directly. |

Alt text: Pros and cons of ADP pricing

Caption: ADP’s pricing has several pros and cons, mostly around transparency, hidden costs, and ROI for businesses.

Since ADP does not publicly disclose its exact pricing, estimates from users based on various factors include:

Implementation fee: A one-time setup cost, typically around $2,000, covering onboarding, backend setup, and employee integration into the system.

Monthly base bee + Per employee cost: A fixed monthly fee, along with a per-employee charge. Reports suggest $44 per employee on payroll and $7 per employee for reporting (not on payroll) (source: Reddit).

Payroll processing fee: Additional fees may apply for each payroll run, depending on the specifics of the business's payroll cycle.

ADP currently offers 3 months of free payroll processing for new clients who sign up and begin processing payroll by July 31, 2026.

Key terms and conditions:

Rivermate takes a different approach to payroll and global hiring by focusing on transparent pricing and a streamlined process for managing international teams.

ADP is a well-established provider with a broad range of services, Rivermate offers unique advantages that may make it a better fit for certain businesses, particularly those looking for simplicity and cost-effectiveness in managing global payroll.

One of Rivermate’s standout features is its transparent pricing model. Unlike ADP , which can have complex pricing structures with various hidden fees for add-ons and international services, Rivermate provides clear, fixed-rate pricing.

This transparency allows businesses to better forecast and manage their payroll expenses without worrying about unexpected costs for services like contractor management or compliance in multiple countries.

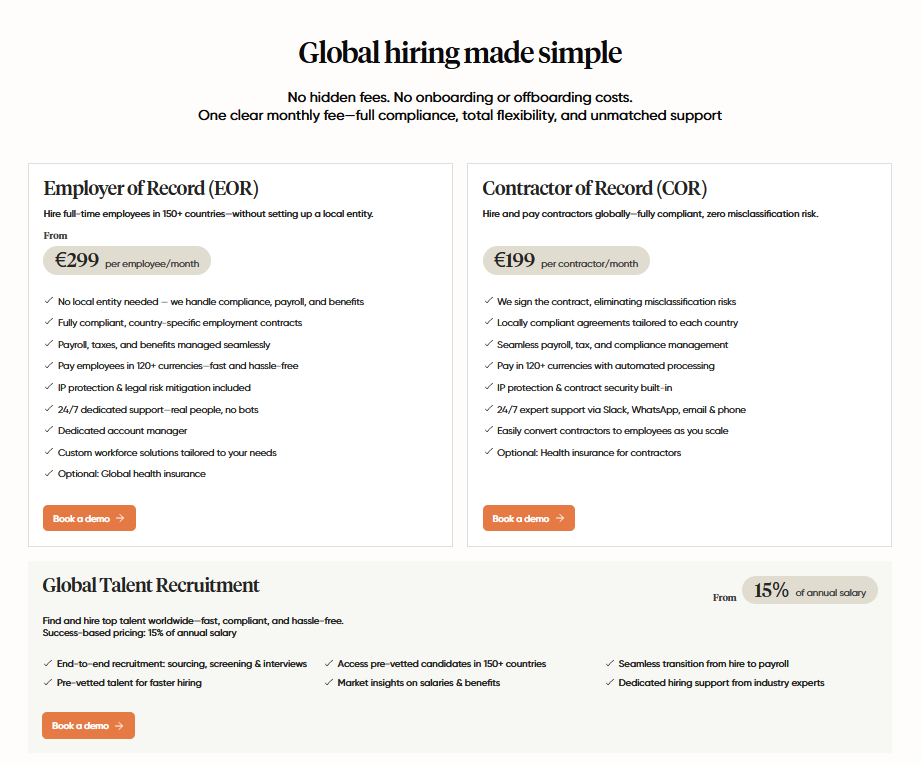

Caption: Rivermate offers transparent pricing compared to other EOR and payroll providers

Rivermate’s pricing is built specifically for businesses that are scaling internationally. It offers a seamless, scalable solution for companies that need to hire and manage employees across different countries, without the administrative burden of dealing with multiple payroll partners or worrying about local compliance.

Reviews cite that Rivermate is known for offering global scalability across 150+ countries

Reviews cite that Rivermate is known for offering global scalability across 150+ countries

Rivermate’s focus on affordability and efficiency makes it an attractive option for companies that want to manage global teams without breaking the budget. Its pricing model includes all essential services, from multi-level payroll processing to compliance management, without the additional costs that often come with ADP ’s more feature-rich, but complex packages.

Caption: Rivermate’s pricing offers cost-effectiveness for global teams

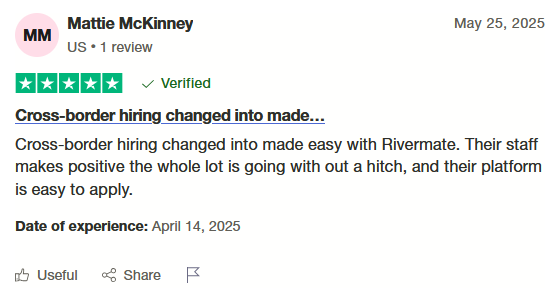

Rivermate simplifies the global hiring process with its all-in-one platform that helps businesses quickly onboard employees worldwide. By handling the complexities of local compliance, taxes, and labor laws, Rivermate reduces the time and effort needed to hire internationally.

Reviews confirm that Rivermate makes hiring a global team seamless

When comparing ADP pricing and Rivermate pricing, the differences in pricing models, scalability, and transparency become clear. ADP ’s extensive service offerings and established reputation make it a solid choice for large enterprises with complex needs.

However, its pricing structure can be intricate, with hidden fees for additional services like global payroll, contractor management, and compliance. This can lead to higher costs, especially for growing businesses with international teams.

On the other hand, Rivermate provides a streamlined and transparent solution designed to simplify global payroll and hiring. Its fixed, transparent pricing offers businesses a clear, predictable cost structure without the hidden fees that often come with ADP .

For companies expanding internationally, Rivermate’s international scalability and cost-effectiveness make it an attractive alternative, especially for businesses looking to avoid complex pricing and administrative burdens.

Want to know how Rivermate can make a difference to your international hiring without overshooting costs?

Book a free 30-minute consultation with a Rivermate who will give you a personalized tour as well as help choose the right plan for your business.

Run by ADP ® is a payroll and HR management solution designed primarily for small to mid-sized businesses. It provides services like payroll processing, tax filing, employee self-service portals, and HR tools.

ADP ’s pricing is typically based on the number of employees, location, and service package chosen. It includes a base fee and a per-employee cost, with additional charges for add-ons like global payroll and compliance services.

Yes, ADP provides benefits administration services across the U.S. It helps businesses manage employee benefits such as health insurance, retirement plans, and other perks, ensuring compliance with both federal and state regulations.

Rivermate offers a transparent, fixed pricing model that simplifies budgeting for businesses. Unlike ADP , which often includes hidden fees for services such as global payroll, contractor management, and compliance, Rivermate provides clear and predictable costs.

There are no surprise charges, making it easier for businesses to forecast payroll expenses. This predictability and transparency make Rivermate an attractive alternative, particularly for companies looking to scale internationally without being burdened by hidden costs.

Yes, Rivermate supports businesses with global payroll in over 160 countries, providing an easy-to-manage platform for companies with international teams. It simplifies the complexities of managing payroll, taxes, and compliance across multiple regions.

While ADP can work for small businesses, its complex pricing and wide range of services may not be cost-effective for smaller organizations. Rivermate might be a better fit due to its simplified, transparent pricing for global payroll and hiring needs.

Lucas Botzen is the founder of Rivermate, a global HR platform specializing in international payroll, compliance, and benefits management for remote companies. He previously co-founded and successfully exited Boloo, scaling it to over €2 million in annual revenue. Lucas is passionate about technology, automation, and remote work, advocating for innovative digital solutions that streamline global employment.

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demo

International Recruitment

Discover the best ways for U.S. companies to hire foreign employees legally, including visa sponsorship, contractors, or using an Employer of Record.

Lucas Botzen

International Recruitment

U.S. companies can hire foreign contractors, but compliance matters. Explore taxes, misclassification risks, and safer alternatives like EOR services.

Lucas Botzen

Industry Insights and Trends

Hiring across borders has always been challenging, and that still holds true today. It can be hard to manage local laws, taxes, contracts, payroll, and onboarding when your team is in different countries. This is where EOR platforms like Deel step in. They help businesses bring on international workers and contractors without needing local entities. Yet, as we approach 2026, many companies are rethinking whether Deel is still the right fit for them. You may find yourself craving quicker support or looking for greater flexibility. Maybe you want pricing that matches your growth stage more closely. The truth is, global hiring is not a one-size-fits-all approach. The silver lining? There are fantastic **alternatives to Deel** available. In this guide, you’ll find the best platforms for hiring, paying, and managing talent worldwide. This helps you stay compliant and in control.

Lucas Botzen