Remote Work and Productivity

Manage Contractors Remotely: Best Practices for Global Teams

Discover best practices to manage contractors remotely, avoid misclassification risks, and streamline global contractor payments and compliance.

Lucas Botzen

Remote Work and Productivity

11 mins read

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

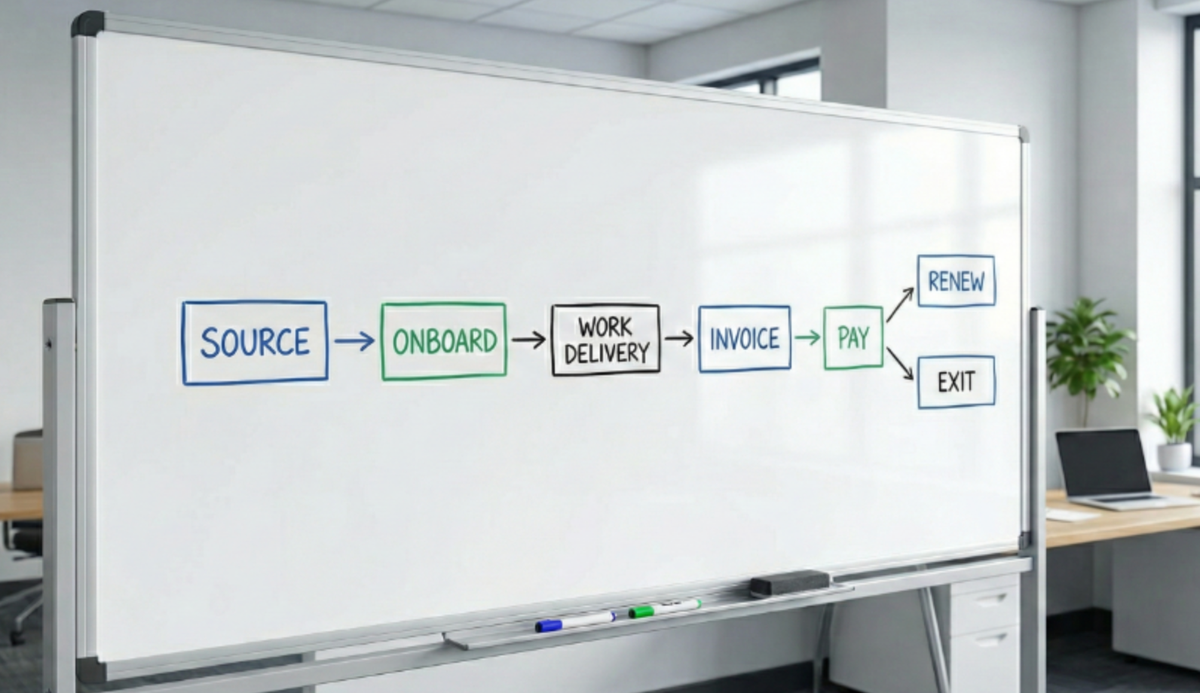

Book a demoManaging remote contractors means working with independent professionals who support your business without being on your payroll, often from another city or country. Day to day, it looks like agreeing on deliverables and deadlines, sharing the context and access they need, reviewing their work, and making invoicing and payments predictable.

The biggest difference compared with employees is that contractors are brought in for results, not hours. They usually decide how they work and when they work, as long as they deliver what you agreed.

If those contractors are based internationally, there are a few extra moving parts to plan for, like currency, local invoicing norms, and limited overlap for real-time communication.

Managing contractors remotely is basically running remote work with independent specialists who are not on your payroll and who might be part of a wider remote workforce, working from a different city or country. You set clear deliverables and deadlines, give the right context, check in on progress, review what they deliver, and make sure invoices get approved and paid on time.

The main difference between managing contractors and managing employees is the focus. Contractors are hired for a result and not for showing up from 9 to 5. Most contractors choose their own working hours and workflow, which is common in remote work. Your job is to be clear about what “done” looks like, when it is due, and how feedback and revisions will work.

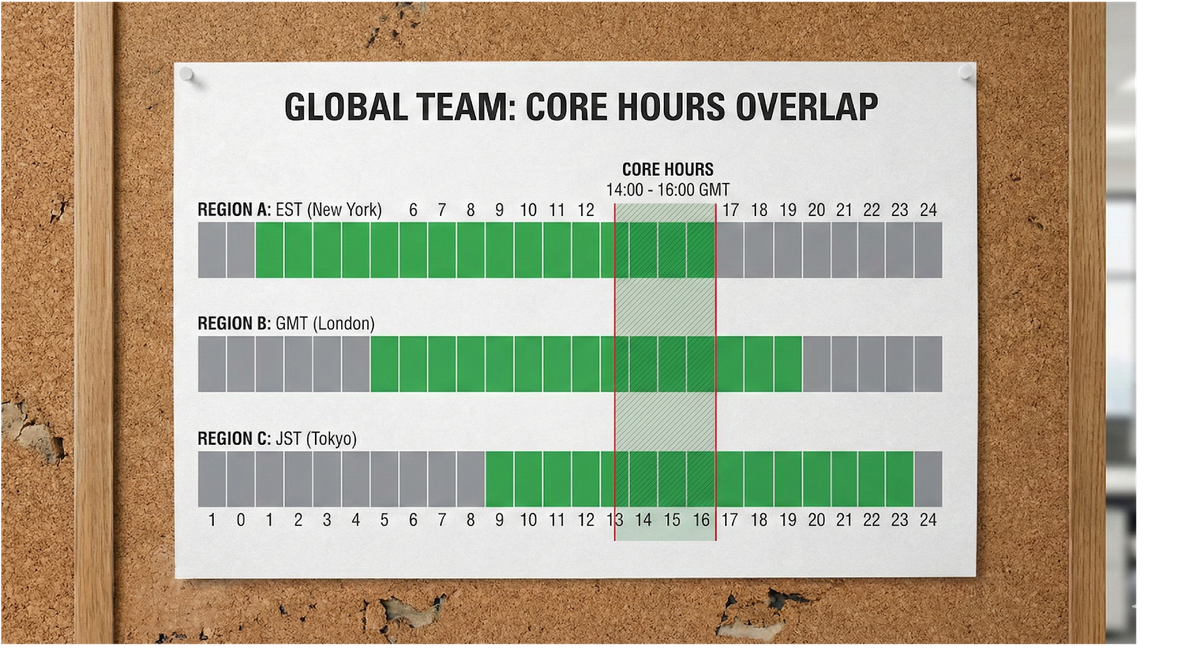

When contractors are based internationally, you also have to deal with a few extra realities that come with a global workforce. Payments may need to go out in multiple currencies, invoice formats can vary by country, and your remote setup may mean you only share a small overlap window each day for real-time questions.

Companies hire remote contractors so that they can move quickly. Hiring a contractor can add specialized expertise or a pair of extra hands without the time and commitment of a full-time employee.

They are especially useful when the task is temporary or specialized, for example: launching a new page, building an integration, running an SEO migration, or cleaning up a reporting workflow. Contractors also expand the hiring pool beyond the local market, which makes it easier to find the right person for the job and build a flexible contractor workforce. The upside only holds when the engagement is set up well from day one. Clear scope, clear ownership, and a clear definition of “done” prevent most problems later.

Managing contractors remotely can be a fast, flexible way to scale, but it also brings operational and legal challenges that many companies underestimate. Once you’re working across borders, the basics get more complex: defining the relationship correctly, setting clear terms, and making sure you do not accidentally manage contractors like employees, which can increase misclassification risk.

Below are the most common operational and legal challenges companies face when managing contractors remotely:

Contractor misclassification happens when someone is treated like an employee in practice but labeled as an independent contractor on paper. This is one of the biggest risks in global contractor management because classification tests vary widely and enforcement can be strict.

In the United States, guidance and rules focus on whether a worker is economically dependent on the company or truly in business for themselves. The U.S. Department of Labor provides guidance and rulemaking resources around employee vs. independent contractor determinations.

Globally, many countries look at factors like:

Misclassification can lead to fines, back taxes, penalties, legal disputes, and reputational damage. If you want a deeper dive, Rivermate’s guide on avoiding misclassification is a strong internal reference.

When you manage contractors remotely, your contract is your control center. A vague agreement invites scope creep, payment disputes, and confusion about ownership.

Your contractor agreement should clearly cover:

Scope clarity protects both sides. Contractors do better work when expectations are specific, and businesses avoid the “we assumed this was included” problem. It also supports project completion.

Pro tip: attach a scope-of-work appendix that is easy to update per project, while keeping core legal terms consistent. If contractors will handle sensitive information, spell out access rules and security expectations clearly.

Paying international contractors sounds simple until it isn’t. Common friction points include:

Late or inconsistent payments damage trust quickly, especially when contractors rely on predictable cash flow.

A practical approach is to standardize:

When teams scale, manual payments become error-prone. This is where a centralized system or managed solution reduces churn, admin work, and payment disputes. Many teams also use project management platforms to connect milestones with approvals and payments.

Tax obligations for contractors vary significantly by country. In some places, contractors handle all taxes themselves. In others, companies may have withholding, reporting, or documentation expectations depending on the relationship, the amount paid, or the contractor’s local status.

To stay on the safe side, build a contractor compliance checklist that includes:

This helps reduce risk and improve tax compliance over time.

Time zones are a productivity multiplier when managed well, and a chaos engine when managed poorly.

Remote contractor teams run smoother when you define:

Standardize communication tools so decisions are easy to find and work does not stall.

The biggest mistake companies make is measuring contractors like employees. Contractors should be managed by outputs, not by constant supervision.

Instead of tracking hours as your primary KPI, focus on:

This approach supports productivity and project success while also helping ensure compliance by avoiding employee-like control.

Managing contractors remotely becomes easier when you treat it like a repeatable system rather than a series of one-off decisions. The most effective setups are consistent, simple, and easy to repeat across teams.

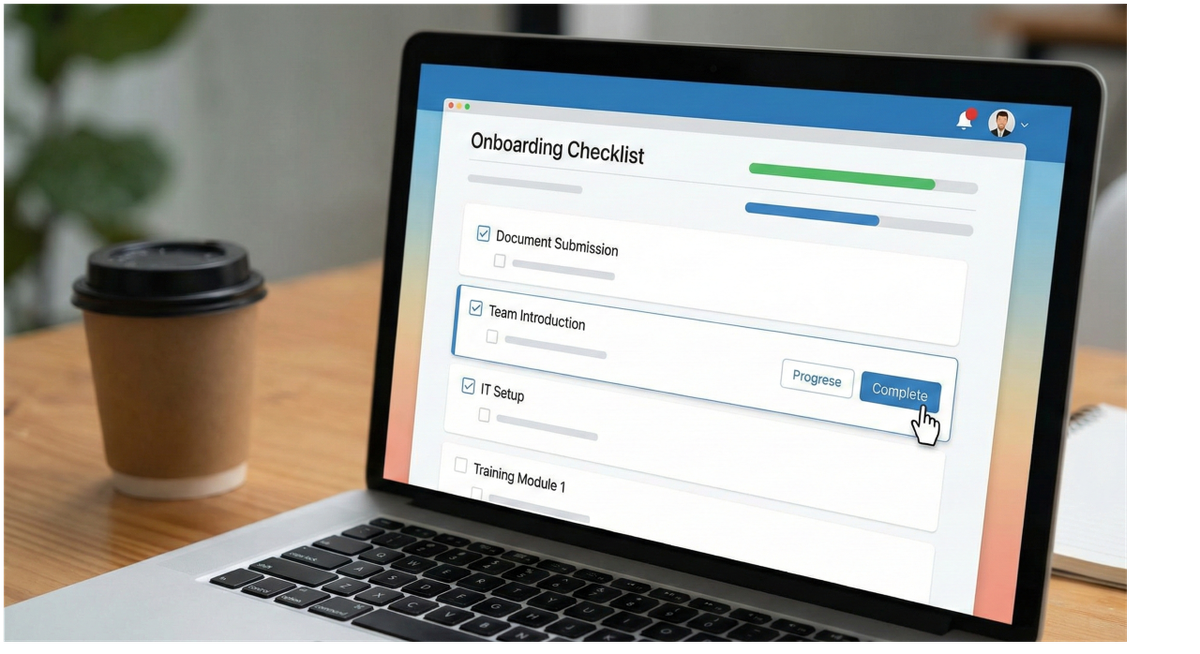

Contractor onboarding does not need to be long, but it should be deliberate. A kickoff call plus a written summary of scope, priorities, and clear communication norms can prevent weeks of back and forth later.

Make sure contractors know where work is tracked, who reviews deliverables, how feedback is shared, and how invoices are submitted to avoid communication challenges. Confirm access boundaries and basic data security expectations, especially if the contractor will touch sensitive systems or file-sharing data.

Contracts and scopes should live in one place, work should be tracked in one primary system, and invoices should follow one approval path. You do not need complicated tooling, but you do need the right tools.

The goal is to avoid scenarios where Finance cannot find approvals, managers cannot locate the agreement, or contractors do not know who to contact about payment status.

Global contractor compliance is an ongoing practice that should grow with your contractor headcount and geographic reach.

The safest approach is to keep the relationship focused on results, avoid employee-like controls, and re-check classification assumptions when scope or working patterns change. Getting local guidance early can save you from costly rework if you enter a new country or hire contractors for roles that look close to employment.

Even though contractors are not employees, relationships still drive results. Contractors deliver better work when they have clear briefs, fast feedback, and consistent payments.

Respect time zone differences and boundaries, share enough context to support good decision making, and treat the relationship as a partnership. Strong contractor relationships improve reliability, reduce ramp-up time, and make it easier to scale your contractor network.

As companies grow, direct contractor management can become complex, especially across multiple countries. This is when managed solutions can help.

A Contractor of Record can help when you want to keep a contractor model but need support with contracts, compliance, and payments. An Employer of Record is more appropriate when the worker should be hired as an employee, or when contractor classification is too risky given the role, country, or working relationship.

A good rule of thumb is that if the work is ongoing, tightly integrated into your business, and managed like an internal role, employment may be the safer path.

Managing contractors remotely does not need to be hard, but it does require a clear plan. When you define a clear scope with measurable deliverables, timelines, and an agreed review process, you remove the uncertainty that causes most delays and rework.

You build trust when payments are reliable and tied to simple, clear milestones. If you also set a steady way to communicate across time zones, like regular written updates and a set time to give feedback, everyone can see progress without constant follow-ups.

If you are building a global contractor team, focus on clarity, consistency, and compliance-aware working practices. Clear expectations keep work aligned, consistency makes performance repeatable, and compliance awareness protects the business as the team grows across countries and legal systems. When contractors know what success looks like, how decisions get made, and when they will be paid, they stay engaged and can plan their workload with confidence.

Managing global contractors becomes significantly easier when you have the right infrastructure in place. With Rivermate, you can onboard contractors compliantly, handle international payments with confidence, and ensure your workforce aligns with local labor regulations across countries.

Explore how Rivermate can support your global contractor strategy today.

You manage contractors remotely effectively by defining deliverables and timelines clearly, onboarding them with the right context and access, communicating consistently with an async-first approach, doing regular check-ins, and paying remote contractors reliably. Results-based tracking using milestones and clear “done” requirements is usually the most effective for remote contractor management and helps maintain productivity.

The biggest risk is misclassification, especially if the relationship starts to resemble employment. This risk increases when contractors are tightly controlled, expected to follow fixed schedules, or engaged indefinitely without a clear project scope.

Usually, no. Contractors are typically paid via invoices rather than payroll. They don’t have employment contracts. What matters most is a consistent process for invoice submission, approvals, payment timelines, and documentation.

An Employer of Record can help when the worker should be hired as an employee or when contractor classification is too risky in a specific country. If the person is genuinely independent, but you want support with compliance and payments, a Contractor of Record model is often a better fit.

Lucas Botzen is the founder of Rivermate, a global HR platform specializing in international payroll, compliance, and benefits management for remote companies. He previously co-founded and successfully exited Boloo, scaling it to over €2 million in annual revenue. Lucas is passionate about technology, automation, and remote work, advocating for innovative digital solutions that streamline global employment.

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demo

Remote Work and Productivity

Discover best practices to manage contractors remotely, avoid misclassification risks, and streamline global contractor payments and compliance.

Lucas Botzen

Remote Work and Productivity

Can you work remotely from another country? Find out what’s legally possible, and how EOR services help companies employ workers in foreign countries.

Lucas Botzen

Global Employment Guides

What is global mobility? Global mobility explained: strategy, programs, benefits and risks of relocating and managing employees across borders while ensuring legal compliance.

Lucas Botzen