TL;DR

-

EOR (Employer of record): Think of it as a partner who hires and manages your employees abroad, handling all the complicated tasks like compliance, payroll, taxes, and benefits—so you don't have to worry about the legal details.

-

Payroll solution: A service that processes employee pay and handles tax deductions, but it doesn’t take on the legal responsibilities of being the employer or manage compliance in the way an EOR does.

-

Key differences:

- EOR: Takes on full legal employer responsibilities, ensures global compliance, and manages employee benefits.

-Payroll: Focuses on paying employees and managing taxes, but your company stays the legal employer and handles compliance.

-

When to choose EOR:

-

You’re expanding into new countries and want to avoid setting up local entities.

-

You have remote teams across different regions and need to stay fully compliant.

-

You want to hire both contractors and full-time employees globally without legal headaches.

-

When to choose payroll:

-

Cost comparison:

EOR vs. Payroll Solution: Which Model Fits Your Global Hiring Needs?

Expanding your workforce globally presents unique challenges, particularly when it comes to managing international hires. For businesses looking to hire employees across borders without establishing local entities, two common solutions are employer of record (EOR) services and payrolling solutions.

While both EOR and payroll models enable companies to hire remotely, they differ in terms of legal responsibility, compliance management, and the range of services offered.

This comparison is essential for HR and operations leaders who need to choose the right solution based on their company’s size, global hiring strategy, and risk tolerance.

In this guide, we will explore the differences between EOR services and payrolling solutions, examining how each works, the costs involved, and the benefits they offer.

What is an employer of record (EOR)?

An EOR is a legal entity that takes on the responsibility of hiring and managing employees for a company in a foreign country, without the need for the business to establish a local entity. The EOR becomes the legal employer, handling compliance, payroll, taxes, employee benefits, and other administrative duties.

Let’s understand this better with an example.

Imagine a US-based tech startup wanting to hire a developer in Germany but without the hassle of setting up a local entity. By working with an EOR, the startup can onboard the developer quickly.

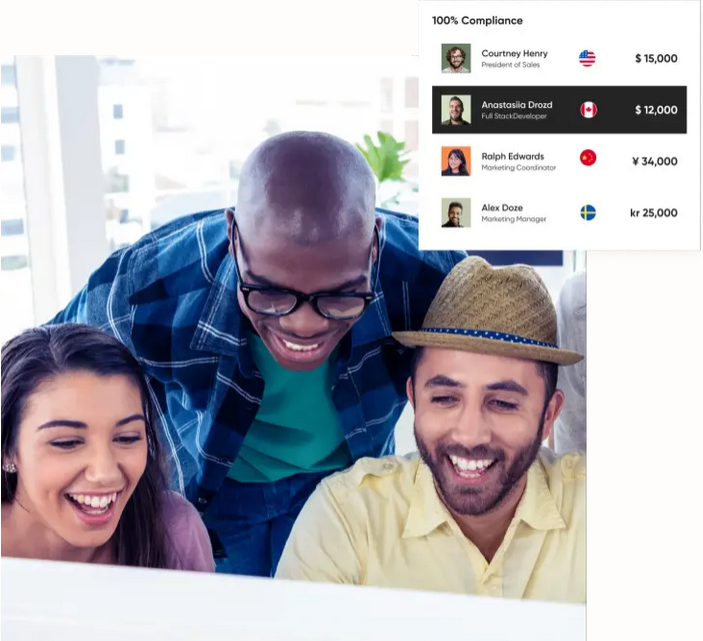

Caption: An EOR handles hiring and managing employees in foreign countries, eliminating the need for a local entity.

Caption: An EOR handles hiring and managing employees in foreign countries, eliminating the need for a local entity.

The EOR takes care of all local compliance, including employment contracts, tax filings, and employee benefits. This way, the startup can focus on growing its business while staying fully compliant with German labor laws.

What is a payroll solution?

A payroll solution is a service that helps businesses manage the process of paying their employees, ensuring that employees are paid accurately and on time while complying with local tax and labor laws.

Payroll services typically include:

- Processing employee wages

- Calculating taxes

- Handling deductions (such as benefits and retirement contributions), and

- issuing paychecks or direct deposits

These solutions can be managed in-house with dedicated software or outsourced to third-party providers who handle all the payroll processing tasks.

For example, a small business might use a payroll service to automate the calculation of employee salaries and tax withholdings. The provider ensures compliance with local tax laws, helps avoid costly fines, and streamlines the payment process, saving the business time and resources.

EOR and payroll services: key differences that set them apart

The key differences between an EOR and a payroll solution lie in the scope of services, legal responsibility, and compliance management.

Here’s a breakdown of how they differ:

| Differentiator |

EOR |

Payroll service |

| Legal responsibility |

EOR becomes the legal employer, handling contracts, taxes, and compliance. |

The company remains the legal employer; payroll service only processes payments and taxes. |

| Scope of services |

Comprehensive: Recruitment, contracts, payroll, benefits, compliance, and visa support. |

Limited to payroll processing, tax calculations, and issuing payments. |

| Employee classification |

EOR handles correct classification of workers (employee vs. contractor). |

Companies must ensure correct worker classification. |

| Compliance management |

Full compliance with local labor laws, statutory benefits, and legal updates. |

Handles tax compliance only; the company manages broader legal compliance. |

| Global scalability |

Supports international hiring in multiple countries without setting up local entities. |

Typically localized to one country; scaling internationally requires setting up entities. |

Table caption: Key differences that sets apart an EOR and a payroll service provider

Use cases: when to choose EOR vs. payroll

Choosing between an EOR and a payroll solution depends on your company's global hiring needs, legal responsibilities, and long-term growth strategy.

Below are the key scenarios to help determine when each option is best suited for your business.

1. Expanding into a new country without a local entity

If your business is expanding into a new market and doesn’t want the hassle of setting up a local entity, an EOR is the ideal choice. The EOR becomes the legal employer, handling all compliance, international payroll, taxes, and benefits for your international employees.

Why EOR is ideal:

Setting up a legal entity in a new country is time-consuming and costly. An EOR allows you to hire employees quickly and compliantly, without the need for a local entity.

2. Managing remote employees across multiple countries

If your company hires remote employees in multiple countries, an EOR is the best option. It simplifies the complex process of managing employees across various legal environments and ensures compliance in every location.

Why EOR is ideal:

An EOR handles all country-specific employment requirements—contracts, payroll, tax compliance, benefits, and more—ensuring consistency in your global workforce while reducing administrative complexity.

3. Hiring contractors globally

If you're hiring contractors on a global scale but don't need to worry about compliance risks, a global payroll partner can be used to manage contractor payments and ensure tax deductions where applicable.

Why payroll is Ideal:

Payroll services help businesses process contractor payments, track taxes, and manage compensation. However, if you require contractor classification and legal oversight to avoid misclassification, an EOR would be the better fit.

4. Simplifying HR operations for small-scale global hiring

If your company is hiring employees or contractors in just one or two countries, and you want to keep HR processes simple, a payroll solution is likely sufficient.

Why payroll is Ideal:

Payroll solutions are more cost-effective for smaller-scale hiring operations. They help ensure employees are paid on time and comply with basic tax regulations without the need for the broader services provided by an EOR.

5. Handling complex global employment compliance

If your company operates in multiple countries with varying labor laws, using an EOR is the best choice to ensure full compliance with local laws, especially for complex sectors like finance or healthcare.

Why EOR is ideal:

EORs specialize in managing legal compliance and tax requirements across borders. They take on the responsibility of maintaining up-to-date knowledge of local regulations, offering peace of mind to HR and legal teams.

The decision between using an EOR or a payroll solution hinges on the scope of your global hiring needs. If your business is looking to scale rapidly, hire international employees, or manage complex compliance, an EOR offers a comprehensive, compliant, and scalable solution.

For smaller-scale or short-term hiring needs, a payroll service may suffice, offering simplicity and cost-effectiveness. Choose based on your growth plans, risk tolerance, and the level of support you need across borders.

Costs and pricing models: EOR vs payroll

Understanding the costs and pricing models of EOR and payroll services is critical for businesses as they evaluate the best option for managing their global workforce. Both models come with unique pricing structures that reflect the level of service and the complexity involved.

Here, we break down the cost considerations for both options:

1. EOR costs

EOR services typically operate on a per-employee, monthly fee structure. This fee covers a wide range of services, including legal employer status, payroll processing, tax filings, benefits management, compliance support, and local expertise. The pricing can vary depending on factors such as the country, the complexity of employment laws, and the additional services needed.

Key cost elements:

- Base monthly fee: Typically ranges from $199 to $650 per hired employee, depending on the country.

- Service add-ons: Additional costs may apply for specific benefits, visa/immigration support, or specialized legal services.

- Benefits and insurance: EORs manage employee benefits and statutory contributions, which are included in the fee but may differ based on country-specific requirements.

EOR pricing is predictable, with all services bundled into one monthly fee. Businesses benefit from having a comprehensive solution that includes compliance management, payroll, and benefits, without needing to manage multiple vendors or establish local entities. This makes it easier to forecast costs, especially when scaling internationally.

2. Payroll solution costs

Payroll services tend to have a simpler pricing model, often based on the number of employees or contractors being managed. The costs for payroll solutions typically focus on managing employee payments, tax withholdings, and basic compliance. However, the overall cost can vary based on the features and services provided.

Key cost elements are:

- Base fee: Often priced per employee per month or as a flat fee for a group of employees, typically ranging from $10 to $30 per employee.

- Additional services: Many payroll services offer add-ons such as benefits management, compliance support, and tax filings at an additional cost.

- Setup fees: Some payroll providers charge initial setup fees, particularly when integrating with existing systems.

Payroll solutions are often more cost-effective for businesses that only need assistance with processing payroll and basic compliance tasks, especially in one or two countries. They are less expensive than EOR services but provide less comprehensive support. Payroll services are ideal for companies with straightforward needs or smaller-scale operations.

3. Hidden and additional costs

While the base fees for both EOR and payroll services are clear, there may be hidden or additional costs that businesses should consider. These can include:

-

For EOR:

- Custom legal support (e.g., contract drafting, specific legal consultations)

- Global mobility and immigration services (e.g., visas, relocation assistance)

- Special benefits or insurance policies

- Country-specific compliance updates

-

For payroll:

- Fees for compliance with tax laws in multiple regions

- Additional costs for managing benefits or handling international payroll

- Onboarding fees for setting up new employees

4. Total cost of ownership (TCO)

The total cost of ownership is a critical factor when comparing EOR and payroll services. With an EOR, the TCO is generally higher due to the comprehensive range of services provided, including legal compliance, employee benefits, and immigration support. However, this higher cost can be worthwhile for businesses looking for a full-service solution and faster global expansion.

With payroll solutions, the TCO is typically lower, but additional costs may arise for benefits management or international compliance, which may require outsourcing other services. As businesses scale or expand globally, they may find that the cost of managing payroll complexity across borders increases, potentially offsetting the initial savings.

5. EOR vs. payroll solution pricing model comparison table

| Cost factor |

Employer of record |

Payroll solution |

| Base monthly fee |

$199–$650 per hired employee per month |

$10–$30 per employee |

| Service coverage |

Comprehensive: Legal employer status, payroll, taxes, benefits, compliance |

Primarily payroll and tax management |

| Additional costs |

Immigration support, legal consultations, local benefits |

Benefits management, compliance filings, additional services |

| Scalability |

Ideal for global expansion across multiple countries |

Suitable for simple payroll operations, often local or regional |

| Setup costs |

Typically higher due to entity creation and legal setup |

May include setup fees, but lower than EOR |

Table caption: EOR and payroll pricing model comparison

EOR vs. payroll solutions: which option is more cost-effective?

EOR is generally more cost-effective for businesses looking to scale globally and manage all aspects of international hiring under one service. While the initial costs may seem higher, the EOR model eliminates the need for multiple vendors and reduces the risk of non-compliance.

Payroll services are more suitable for companies that only need payroll management and are hiring in fewer countries. They are ideal for small to medium-sized businesses with basic compliance needs.

Benefits and drawbacks of EOR vs. payroll solutions

Choosing between an EOR and a payroll solution involves understanding the advantages and disadvantages of each model. Below, we outline the key benefits and potential drawbacks of both, helping you determine which option aligns best with your business needs.

| Benefits |

Drawbacks |

| Comprehensive compliance management |

Less control over employee experience |

| Global workforce management |

Customization could be difficult |

| Payroll and benefits administration |

Dependency on the EOR |

| Risk mitigation in international employment |

|

| Visa and immigration support |

|

| Easily scalable global expansion |

|

Table caption: Benefits and drawbacks of an EOR

Pros and cons of a payroll solution

| Benefits |

Drawbacks |

| Lower cost |

Limited global compliance |

| Simplicity and efficiency |

No legal employer status |

| Fewer services required |

Limited employee benefits management |

| Flexibility for local operations |

Misclassification risk for contractors |

|

Increased administrative burden |

Table caption: Benefits and drawbacks of a payroll solution

EOR services are ideal for businesses looking for a comprehensive, risk-free solution to manage a global workforce and maintain full compliance across countries.

Payroll solutions, on the other hand, are best suited for companies with more localized needs or those only requiring basic payroll processing.

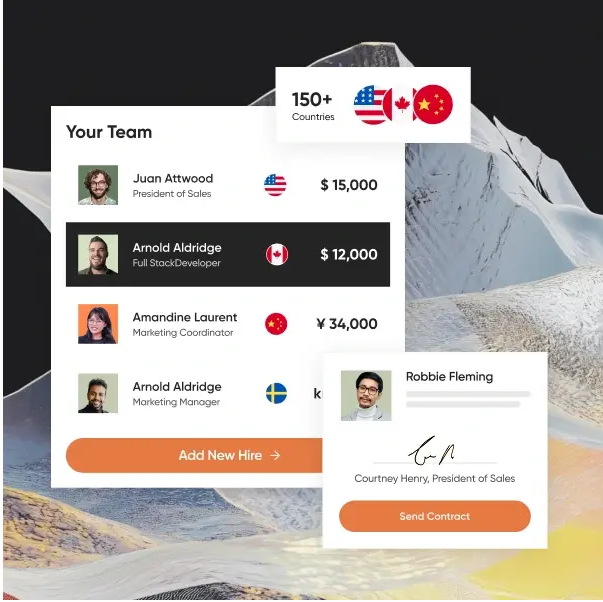

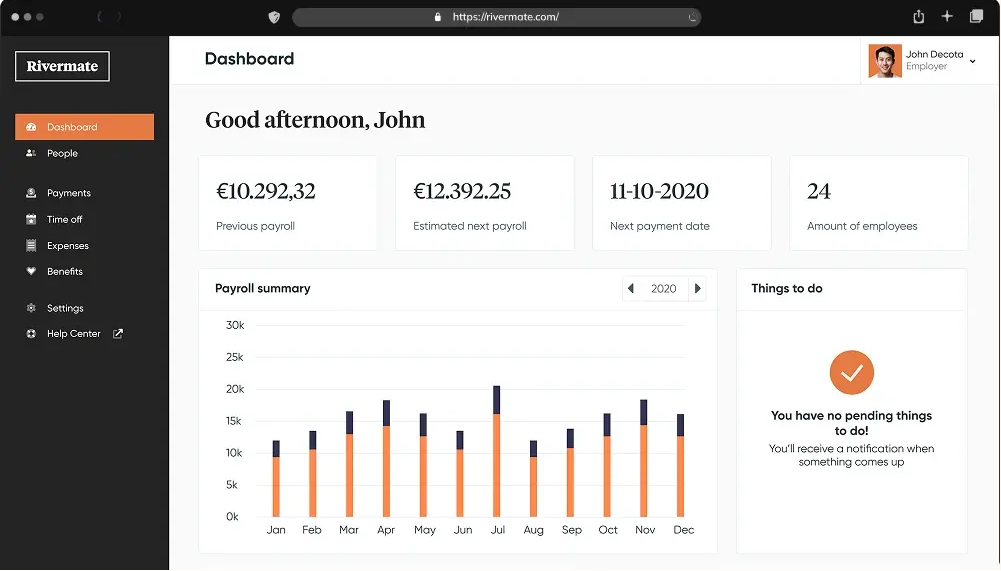

How Rivermate simplifies EOR and payroll needs

Rivermate offers a streamlined solution that simplifies both EOR and payroll services, helping businesses scale globally with confidence.

Whether you’re managing international hires or contractors, Rivermate’s platform provides a comprehensive, cost-effective way to handle compliance, payroll, and legal responsibilities without the need for multiple vendors or complicated processes.

Rivermate combines both EOR and payroll functions into one easy-to-use platform, providing businesses with a single point of contact for all global workforce management needs.

From onboarding to payroll processing, legal compliance, and benefits administration, Rivermate ensures a seamless experience.

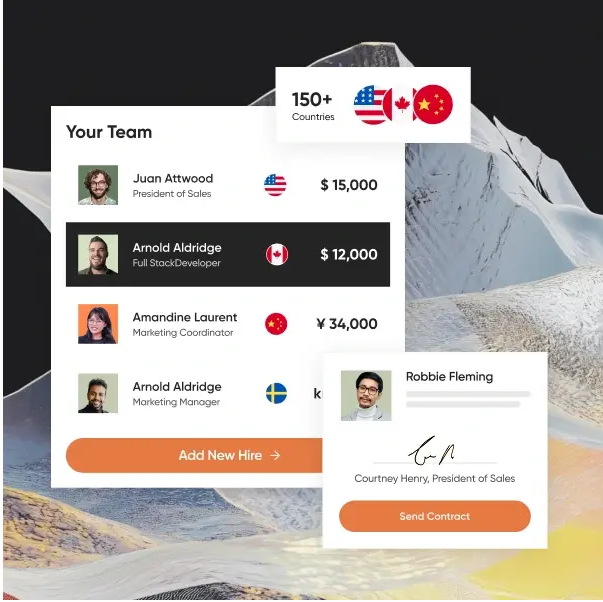

- For EOR: Rivermate acts as the legal employer in over 150 countries, managing contracts, compliance, taxes, and employee benefits.

- For payroll: Rivermate provides full payroll processing services, ensuring accurate salary payments, tax withholdings, and deductions, across multiple currencies and jurisdictions.

Caption: Rivermate is your reliable partner for EOR and payroll, handling onboarding, compliance, and benefits.

Caption: Rivermate is your reliable partner for EOR and payroll, handling onboarding, compliance, and benefits.

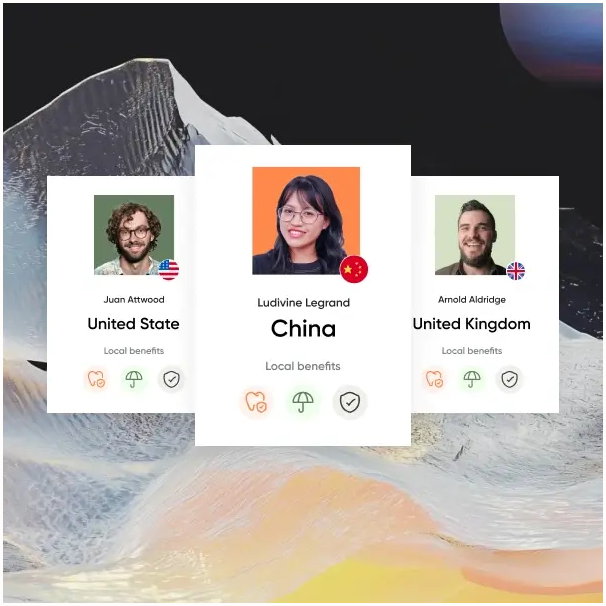

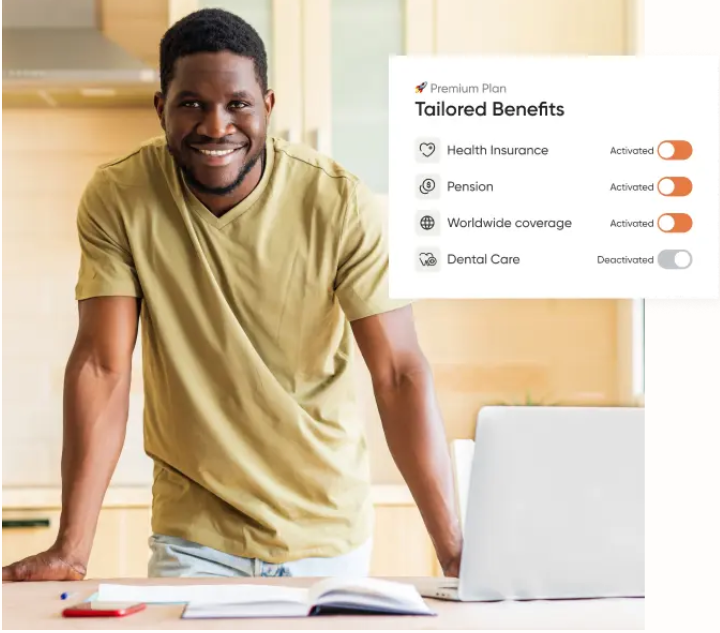

2. Local expertise across 150+ countries

Rivermate leverages a network of in-country experts who handle all legal and compliance nuances specific to each region. This ensures that businesses comply with local employment laws and avoid potential legal issues.

- EOR benefits: The local expertise ensures that employees receive accurate employment contracts, benefits, and taxes specific to their location.

- Payroll benefits: Rivermate ensures tax and legal compliance in every country, reducing the need for internal legal expertise.

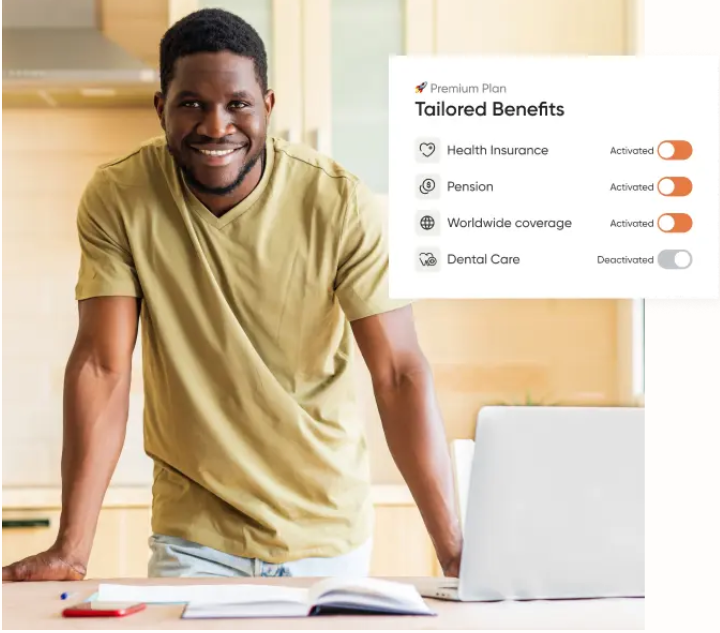

Caption: Rivermate helps give your team the benefits they deserve—wherever they are.

Caption: Rivermate helps give your team the benefits they deserve—wherever they are.

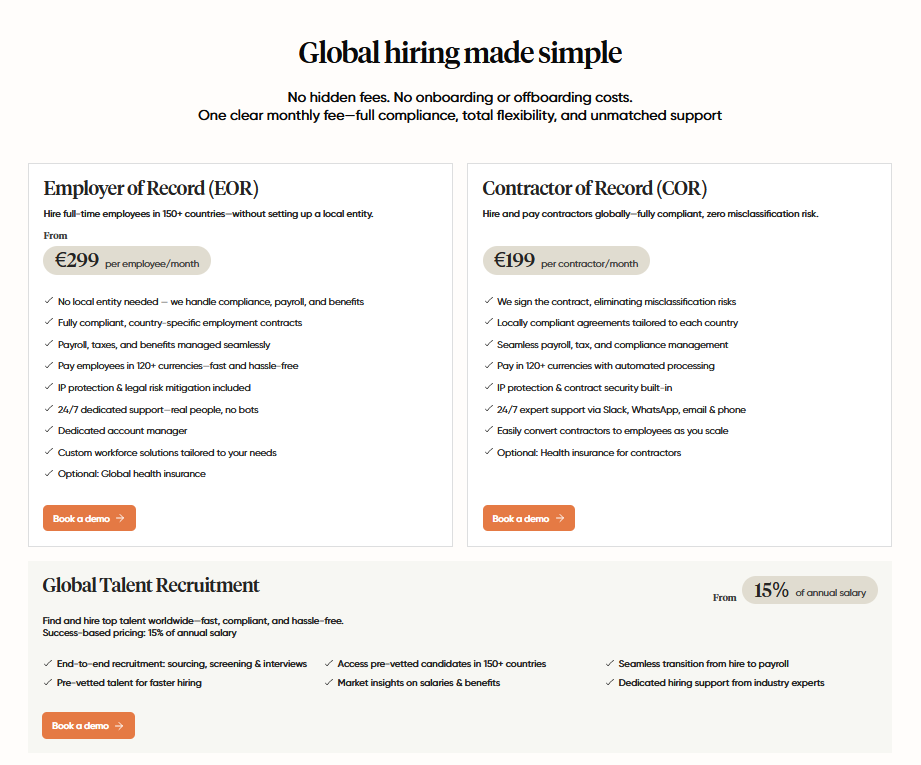

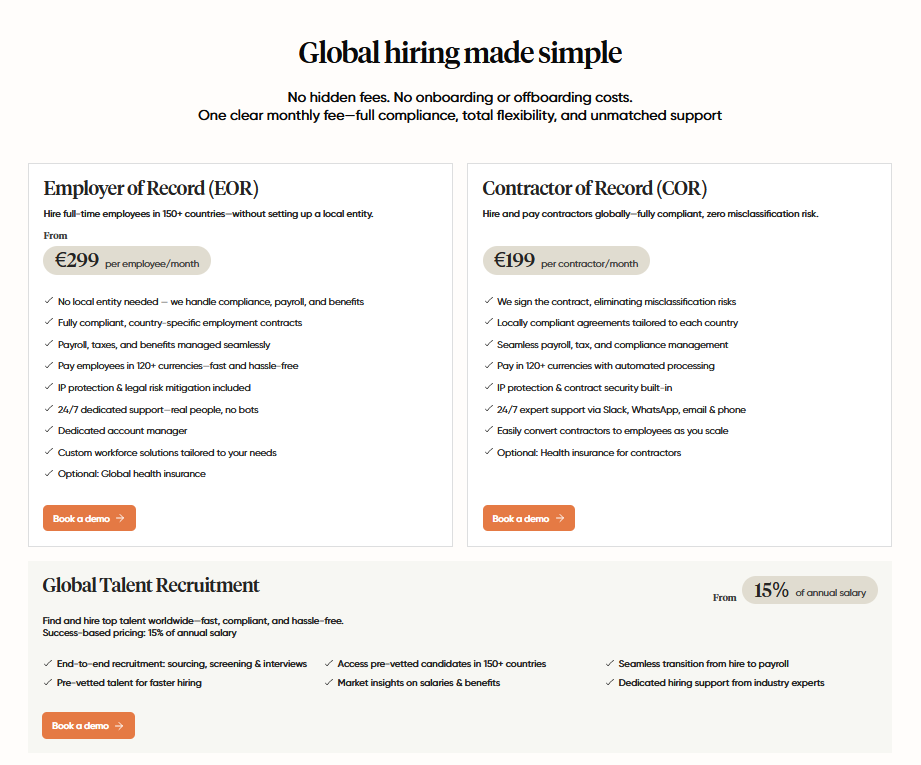

3. Predictable, transparent pricing

Rivermate’s pricing model is simple and transparent, helping businesses maintain predictable budgets. The platform offers one monthly fee per employee for EOR services, with no hidden costs, providing clear visibility into the total cost of ownership.

Alt text: Rivermate pricing for EOR and COR

Alt text: Rivermate pricing for EOR and COR

Caption: Rivermate’s pricing model is simple and transparent, helping businesses maintain predictable budgets.

- EOR pricing: The monthly fee covers all services, including payroll, benefits, legal, and tax management, eliminating unexpected charges.

- Payroll pricing: Rivermate’s payroll solution is based on a cost-per-employee model, making it easier to forecast expenses, especially as you scale globally.

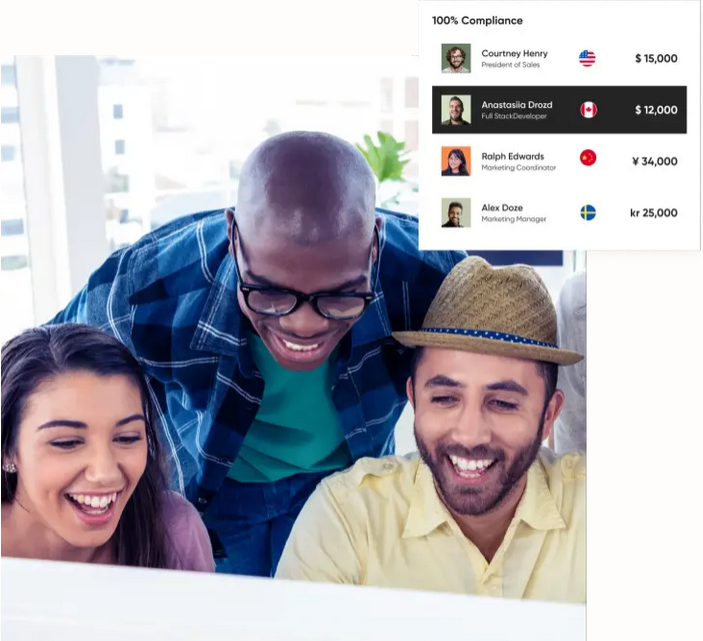

4. Compliance and risk mitigation

Rivermate assumes the legal responsibility for your employees in foreign countries, significantly reducing your risk exposure. The platform automatically monitors global labor laws, ensuring your business stays compliant as regulations evolve.

- EOR advantage: Rivermate’s team of legal experts ensures full compliance with local labor laws, removing the burden from your internal HR team and protecting your business from compliance risks.

- Payroll advantage: Rivermate’s payroll services include tax compliance and reporting, preventing issues like misclassification or payroll errors that could lead to penalties.

Caption: Rivermate offers built-in compliance, everywhere

Caption: Rivermate offers built-in compliance, everywhere

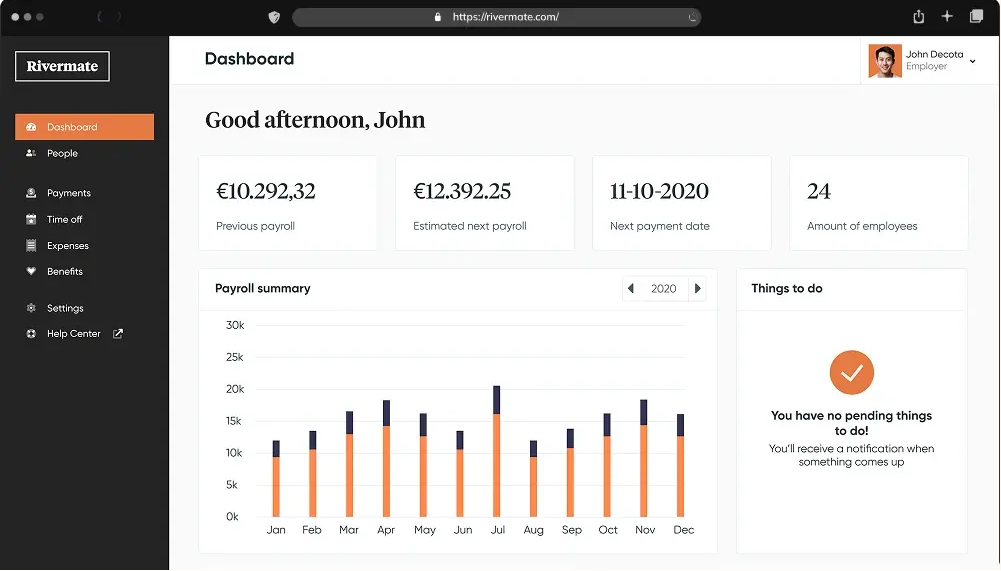

5. Seamless employee experience

Rivermate offers a unified experience for employees, no matter where they are based. Employees can access an intuitive self-service portal to view payslips, request time off, submit expenses, and track benefits. This ensures that global teams have the same high-quality experience, no matter where they are working.

- EOR experience: Employees receive country-specific contracts, benefits, and payroll services, ensuring they are supported throughout their employment lifecycle.

- Payroll experience: Employees have full visibility into their pay details, tax withholdings, and benefits, improving transparency and satisfaction.

Caption: Rivermate helps deliver a seamless employee experience anywhere in the world

Caption: Rivermate helps deliver a seamless employee experience anywhere in the world

6. Scalable for growth

As your company grows, Rivermate grows with you. The platform is designed to scale seamlessly, whether you're hiring a few employees in one new country or hundreds across multiple regions. Rivermate's flexible system adapts to your changing business needs, allowing you to focus on expansion rather than administrative hurdles.

- EOR scalability: Quickly hire and onboard employees in new countries without the delays of entity formation or compliance headaches.

- Payroll scalability: As you scale your global payroll, Rivermate adjusts to the size and complexity of your workforce, handling multiple currencies and regions with ease.

7. Dedicated support team

With Rivermate, businesses gain access to a dedicated account manager and 24/7 support through channels like Slack, WhatsApp, email, or phone. This high-touch service model ensures that all your EOR and payroll needs are met with expert guidance and immediate assistance.

- EOR support: Your dedicated account manager will help guide you through global employment laws, complex compliance issues, and employee needs.

- Payroll support: The support team ensures smooth payroll processing, troubleshooting any issues, and providing timely solutions when needed.

Rivermate simplifies both EOR and payroll needs by offering a comprehensive, user-friendly platform that combines legal compliance, payroll management, and employee benefits under one roof.

Conclusion

Choosing between an EOR and a payroll solution depends on your business's global expansion strategy, compliance requirements, and the level of support needed.

If your company is scaling internationally, managing employees across multiple countries, or navigating complex compliance landscapes, an EOR can provide the comprehensive support and risk mitigation you need.

It offers a full-service solution, handling legal responsibilities, tax compliance, benefits, and payroll, allowing you to focus on growing your business without the administrative burden of managing global employment.

Whether you choose EOR or payroll, Rivermate is here to help you hire confidently, compliantly, and efficiently, ensuring that your global workforce runs smoothly.

If you want a first-hand experience of Rivermate before making a final choice, book a free 30-minute consultation with us.

FAQs

What is the difference between employer of record and payroll?

An Employer of Record (EOR) becomes the legal employer, handling compliance, contracts, and benefits, while payroll services only manage employee payments and tax deductions.

When to use an employer of record?

Use an EOR when hiring employees internationally, needing compliance support, or avoiding the costs of setting up a local entity in foreign countries.

What are the benefits of an employer of record?

EORs offer full compliance, legal employer status, payroll management, employee benefits, and risk mitigation, allowing businesses to hire globally without establishing local entities.

Are employers of record legal?

Yes, EORs are legal entities that comply with local labor laws and handle all legal aspects of employment in foreign countries.

Caption: An EOR handles hiring and managing employees in foreign countries, eliminating the need for a local entity.

Caption: An EOR handles hiring and managing employees in foreign countries, eliminating the need for a local entity. Caption: Rivermate is your reliable partner for EOR and payroll, handling onboarding, compliance, and benefits.

Caption: Rivermate is your reliable partner for EOR and payroll, handling onboarding, compliance, and benefits. Caption: Rivermate helps give your team the benefits they deserve—wherever they are.

Caption: Rivermate helps give your team the benefits they deserve—wherever they are. Alt text: Rivermate pricing for EOR and COR

Alt text: Rivermate pricing for EOR and COR Caption: Rivermate offers built-in compliance, everywhere

Caption: Rivermate offers built-in compliance, everywhere Caption: Rivermate helps deliver a seamless employee experience anywhere in the world

Caption: Rivermate helps deliver a seamless employee experience anywhere in the world